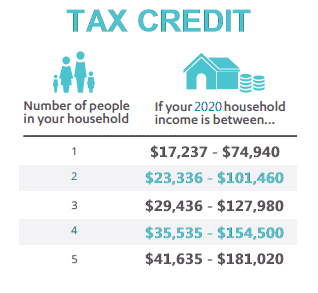

Their maximum contribution is 1485 and their benchmark plan is 1675. These are the repayment limits for the state subsidy received in 2020.

Covered California Income Limits Explained

Covered California Income Limits Explained

In general most low-income limits represent the higher level of.

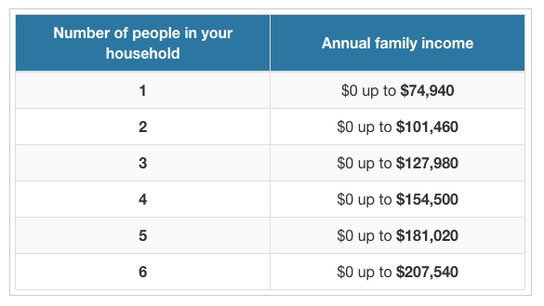

Covered california income limits 2020. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to 8200 on the Bronze Silver and Gold Plans. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians.

Federal tax credit California state subsidy Enhanced Silver plans and AIAN plans. In 2020 that number will be 49460 for an individual 67640 for a couple and 103000 for a family of four. Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income.

Medi-Cal and Covered California have various programs with overlapping income limits. Varied Adaptable Cover To Suit You Your Familys Requirements. In order to be eligible for assistance through Covered California you must meet an income requirement.

2020 State Income Limits Briefing Materials California Code of Regulations Title 25 Section 6932. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Repayment is suspended for any extra premiums you received in tax year 2020 because of the American Rescue Plan which passed in March 2021.

Varied Adaptable Cover To Suit You Your Familys Requirements. Individual Minimum 750 wwwftbcagov Married Couple Minimum 1500 Family of 4 2 Children Minimum 2250 If you arent covered for most of the year in 2020 you could face a penalty at tax time. However due to adjustments that.

Protect Your Financial Stability. Covered California rates are going up 06 on average and the plan benefits are not changing very much. You can start by using your adjusted gross income AGI from your most recent federal income.

Ad Insure Your Salary Against Illness Or Injury. 300 - 400 FPL. Most consumers up to 138 FPL will be eligible for Medi-Cal.

If you make 601. For Bronze and Silver there are no other benefit changes for next year. If your health insurance premiums are over 16 of income then the state of California will cover any additional costs through up-front subsidies.

For people with a household income that is below 400 of the Federal Poverty Level FPL Covered Ca may qualify them to receive financial assistance also called a Subsidy which reduces their premium. Protect Your Financial Stability. Ninety percent of people who have signed up with Covered California get financial help and you could be one of them.

For example for a household at 500 of FPL the subsidy kicks in at 16 of your income. Previously those who made above 400 of the federal poverty line FPL were not eligible for premium tax credits. A 63-year-old couple with a household income of 100000.

1 80 percent of MFI or 2 80 percent of state non-metropolitan median family income. In 2020 those who make between 400 to 600 of the FPL are eligible for subsidies. However starting in 2020 in California those between 400 and 600 of FPL may qualify for state subsidies.

The state of California will supplement those subsidies for. California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families. Ad Insure Your Salary Against Illness Or Injury.

In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. A full listing of exemptions can be found on the FTB website. The state of California is making new financial help available to almost a million Californians many for the first time.

The 100 column display 2020 FPL values as published by the Department of Health and Human Services. Because their benchmark plan costs more than their maximum contribution they would be eligible for 190 in State credit 1675-1485. Be claimed when filing 2020 state income tax returns in early 2021.

The subsidies are for individual Californians who earn. You could even qualify for low-cost or free health coverage through Medi-Cal.