Use for your medical deductable and other health care expenses or save for the future. An HSA is a tax-favored savings account that when paired with a qualified High Deductible Health Plan HDHP allows you to pay for qualified medical expenses or leave the funds invested in the account for future medical expenses tax-free.

Health Savings Account Hsa Plan 2020 Welcome To Blue Cross Blue Shield Of Massachusetts

HSAs generally have lower premiums and can be used for qualified medical expenses.

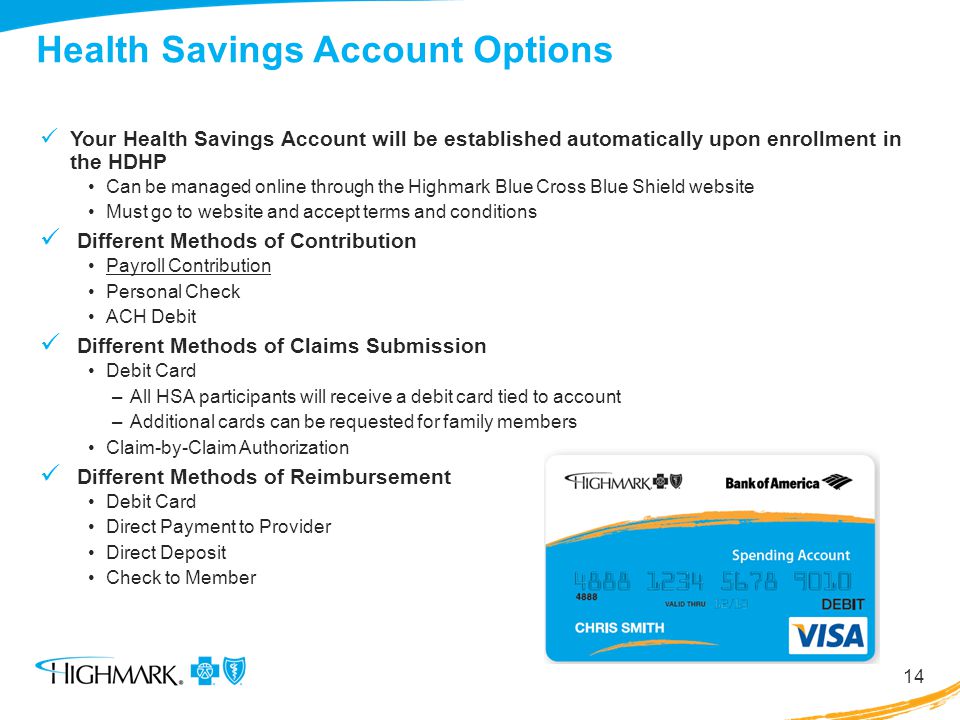

Health savings account blue cross. To be eligible to establish an HSA you must be enrolled in a qualified High Deductible Health Plan HDHP. HSAs can also help you save for retirement when you can use the funds to pay for general living expenses without penalty. A health savings account HSA is a tax-advantaged account that works in conjunction with an HSA-eligible health plan that meets IRS guidelines and allows the participant to save tax-free money for eligible medical expenses.

Your Blue Cross Blue Shield of MA HSA account number can be found on the home page of your Blue Cross Blue Shield of MA Health Financial Accounts portal. Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race color national origin sex age or disability in its health programs and activities. All of our flexible spending and savings accounts include.

Depending on your plan you may have a Flexible Spending Account FSA Health Reimbursement Account HRA andor a Health Saving Account HSA. Or you can keep saving and. You can access your Blue Cross Blue Shield of MA HSA information starting on January 1 2017.

If you have a BlueSolutions plan you can start a health savings account HSA. An HSA works with a health plan that has a high deductible. You can save money in your HSA account before taxes and use the funds to pay for eligible health care expenses.

The account is yours and youll never lose what you put in. Things to Know About HSAs. You can contribute money to your HSA to pay for health expenses like x-rays broken ankles and even everyday health stuff like sunscreen.

If you choose a PPO plan youll be paired with a Health Savings Account HSA. MyBlue offers online tools resources and services for Blue Cross Blue Shield of Arizona Members contracted brokersconsultants healthcare professionals and group benefit administrators. Health Savings Account Tax-free money you and or your employer put into an account.

Learn more about our non-discrimination policy and no-cost services available to you. Health Savings Account Plans Embedded Deductible Plans Health Plan Ded InOut Individual Ded InOut Family Office Copay Coins InOut Out of Pocket Maximum IndivFamily. Health Savings Account 101.

HSA is shorthand for health savings account. Health Savings Account HSA Further Health Savings Account HSA An HSA is a savings account that belongs to the individual and offers triple tax savings. As long as your current balance covers the expense you can spend it.

Think of it like a retirement account for medical expenses. HSA Blue Cross and Blue Shield of Texas What is an HSA. Instead of spending money on higher premiums you can keep that money in an HSA to use on your health care expenses.

Plans with an HSA are different than traditional plans but they can work for almost anyone. Since QHDHPs generally have lower monthly premiums and more out-of-pocket costs HSAs help you pay for qualified health care expenses like prescriptions coinsurance vision dental and more until you reach your deductible. An HSA Health Savings Account is meant to give you more control over how you spend your health care dollars.

You can contribute money to your account and spend it now on qualified medical expenses. Money in an HSA rolls over year after year and is owned by the participant even if they change jobs or health plans. 247 online access to account transactions and other useful resources help to ensure that your account information is available to you any time of the day or night.

An HSA is a type of bank account to help you save for your health care expenses. A Mutual Legal Reserve Company an Independent Licensee of the Blue Cross and Blue Shield Association. To qualify for an HSA you must enroll in an IRS-qualified High Deductible Health Plan QHDHP.

Keep your healthcare dollars under your control and in your pocket. An innovative online portal so you can access information about your account 24 hours a day seven days a week. A Health Savings Account HSA is like a piggy bank where you can deposit pretax contributions to help you pay for medical care.

A Health Savings Account also known as an HSA is a tax-advantaged individually-owned account that is used to pay for qualified medical expenses now and in the future includes dental and vision. A Blue Cross-funded health financial account is automatically paired with each medical plan to help offset your costs during the plan year. Health Support Whether its finding the right doctor or help taking care of you or your families health care needs we have caring people you can talk to and.

Health Savings Account HSA A Health Savings Account HSA is a type of investment account that was created by Congress and is designed to help you save for future healthcare needs. And just like it sounds it will help you save and pay for health care expenses tax free. Contributions interest from investments and ongoing and future qualified withdrawals can all be tax-free.

If you choose an HMO plan youll be paired with a Health Reimbursement Arrangement HRA. Check the Trustee to Trustee Transfer option to ensure your funds are transferred directly. QualifiedHigh-Deductible Health Plans QHDHPs and Health Savings Accounts HSAs are designed to be used together.

:max_bytes(150000):strip_icc()/AccutaneAlternatives_3157249_Color_1-37a9a816d82d49ec8c4d3eadf8798bca.png)