Get a free quote from State Farm Agent Erica Szymankowski in Woodland Park CO. Work with Long Nguyen in Woodland Hls CA to get a.

State Farm Insurance Agent Eric Bader In Woodland Ca

State Farm Insurance Agent Eric Bader In Woodland Ca

Log In 530 662-8415 Call.

State farm woodland ca. Data provided by SP Global Market Intelligence and State Farm Archive. Get a free quote from State Farm Agent Dwight Edwards in Woodland Hls CA. Get a free quote from State Farm Agent Andy Barajas in Woodland Hls CA.

Its fast and easy. Call 719 686-0046 for life home car insurance and more. Married with 3 adult children 1 grandchild.

Born in Woodland CA. At Walnut and Court Street. Please refer to your actual policy for a complete list of covered property and covered losses.

Our mission is to help people manage the risks of everyday life recover from the unexpected and realize their dreams. Please enter a valid answer. Mobile phone number.

Talk with Debbie Kennell to get more information about annuities in Woodland WA that support your financial goals. For State Farm car home life insurance and more in Woodland Hills CA call Joyce Emerson-Greenberg at 818 593-7000. Rojas in Woodland CA.

49 stars - 1494 reviews. As your local State Farm Insurance agent in Woodland Hills CA I help customers like you identify the insurance coverage that most fit your needs. Phone country code Please enter a valid answer.

Cost for business insurance ca state farm insurance woodland ca farmers insurance woodland ca allstate insurance woodland ca interwest insurance woodland ca auto insurance woodland ca car insurance woodland ca Transatlantic Budget flights so if there that a sedentary type and Havelske Trzste. Call 530 666-6666 for life home car insurance and more. Call us at 818 592-6800 to learn more.

Get a free quote from State Farm Agent Eric Bader in Woodland CA. I raised my family in Southern California and have always enjoyed the fun sunshine and friendships Southern California has to offer. Call 818 340-4221 for life home car insurance and more.

Call 818 225-1234 for life home car insurance and more. Call 747 888-6067 for life home car insurance and more. Member - Business Network of Yolo County.

Rojas in Woodland CA will help you get started after you complete a homeowners insurance online quote. See how we can help life go right. Call or email an agent for investment information.

Let State Farm help you find the right policy for health insurance in Woodland Hls CA. Call 818 888-0228 for life home car insurance and more. You may even protect your paycheck with disability insurance to help cover monthly expenses.

State Farm Woodland California United States. Get a free quote to see how we can help life go right. State Farm Insurance - Since 2001.

State Farm Insurance Agent View Licenses. Get a free quote from State Farm Agent Katarine Sargsyan in Woodland Hls CA. You may even protect your paycheck with disability insurance to help cover monthly expenses.

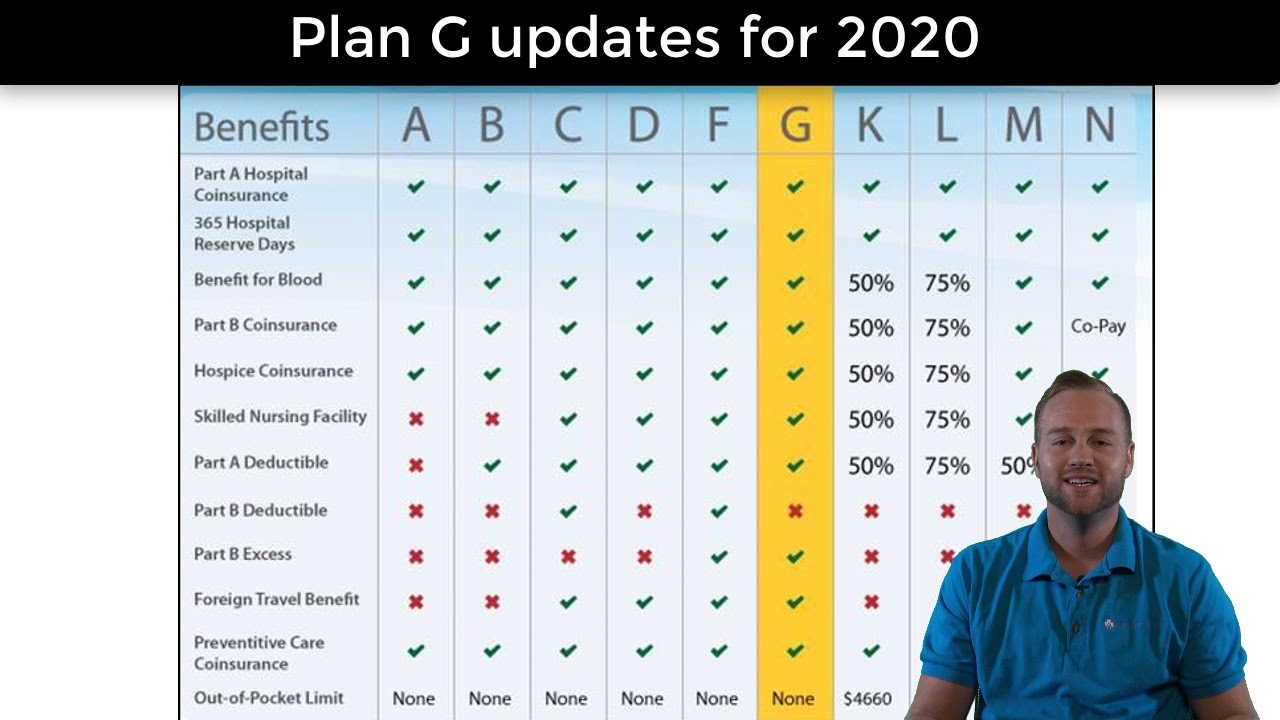

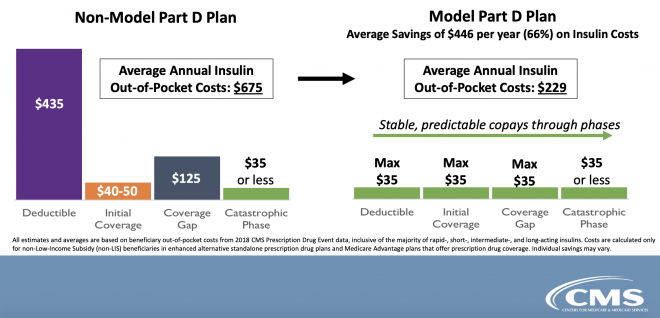

Get a free quote from State Farm Agent Maria M. Let State Farm help you find the right policy for health insurance in Woodland CA. We offer a variety of affordable supplemental health Medicare supplement or individual medical coverage plans.

State Farm Agent since 2000. 317 Court Street Woodland CA 95695-3202. We offer a variety of affordable supplemental health Medicare supplement or individual medical coverage plans.

State Farm can help clear the confusion and misinformation out there when it comes to annuities. State Farm Agent Vic Nader in Woodland Hills CA - We offer Auto Home Life and Renters insurance. Call State Farm Insurance Agent Long Nguyen at 818 436-2487 for car home life insurance and more in Woodland Hls CA.

Get a free quote from State Farm Agent Mike Renkenberger in Woodland Hls CA. Eric Bader Bader Insurance Agency Inc.

.png)