Depending on which program you or your employer chooses you may have a variety of weight loss resources available to you. Programs like Weight Watchers and Jenny Craig dont count.

Does My Health Insurance Cover Weight Loss Treatments Quotewizard

Does My Health Insurance Cover Weight Loss Treatments Quotewizard

A good program teaches you how to permanently change your eating and exercise habits with group or one-on-one support.

Does my insurance cover weight loss programs. Youll find out exactly from your insurer what documents you request a pre-authorization. Some health insurance companies will cover weight loss treatments but what they are willing to cover often is limited. Some health insurance plans even offer a discount on electric toothbrushes to help prevent cavities.

Some people struggle with weight loss success on their own and find that the best solution is to use weight loss programs similar to the Nutrisystem program. July 9 2015 248 PM 4 min read. This type of weight loss program includes diet exercise or medication for weight loss which is monitored by a doctor.

Take time to find out about how your insurance covers the cost of these medicines. Many insurance companies will not consider a request for weight loss surgery unless a patient has previously participated in a medically supervised weight loss program. Is the staff qualified.

If you and your doctor have decided that you need a weight-loss medicine make sure you know how much you will have to pay. All program staff should have training and experience in helping people with healthy weight loss. United Healthcare offers an assortment of health coverage programs to small and large groups with varied benefit packages.

Insurers demand pre-authorizations for many procedures and tests as a way to reduce what it deems unnecessary. And what would lead Aetna to approve and cover a surgery. Coverage does not necessarily cover weight loss programs like Weight Watchers.

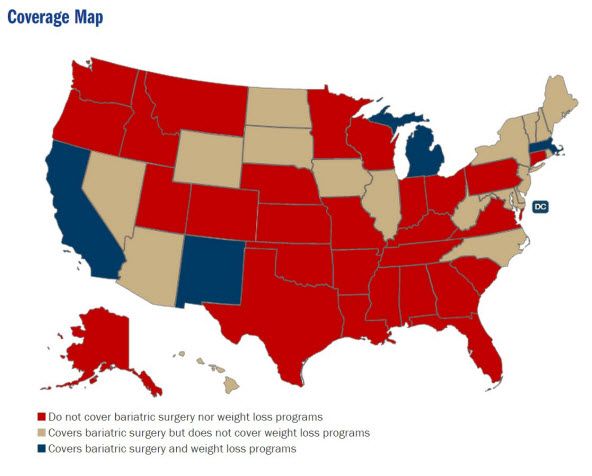

Some Medicare Advantage plans cover health and wellness. Original Medicare may cover some weight management services but doesnt generally cover most weight loss programs services or medications. Because of the high medical costs associated with unhealthy weight levels insurance companies and Medicare may cover the cost of some weight loss programs.

With online wellness tools weight management resources and personalized coaching we offer support to help you reach your healthy goals. Our SpecialOffers let you keep more cash in your pocket with discounts on health-related products weight management programs and gym memberships. Stress and Mental Health.

Call your insurance company for more information about weight loss programs that are covered because there are different stipulations as to how much of the program will be reimbursed. Most of Aetnas plans for example exclude weight loss surgery unless Aetna approves it according to a policy bulletin on the companys website. Original Medicare Part A and Part B does cover weight loss programs therapy screenings and surgery if your doctor or health care provider decides that treatment is medically necessary.

If your insurance policy covers weight loss surgery insurance will only pay for it if. Medicare Advantage Part C plans also cover weight. Weight-loss goals should be realistic and should be reviewed by a health professional.

You have a qualifying body mass index BMI of 35 with obesity-related health problems or a BMI of 40 with no accompanying health problems necessary You participate in a medically supervised diet program before having the procedure. Weight loss programs covered by insurance are part of insurance companies health incentive programs. Insurers rarely cover weight-loss programs themselves.

Gym memberships weight-loss clinics weight-loss surgery massage therapy stress management programs and tobacco cessation programs are just a few of the wellness benefits included in some insurance plans. Weight-loss medicines can range in cost. But they can be expensive.

How Your Insurance Could Pay to Help You Lose Weight.