You will no longer be eligible to receive financial assistance and. Ninety percent of people who have enroll with Covered California get financial help and you could be one of them.

What To Do If You No Longer Qualify For Medi Cal

What To Do If You No Longer Qualify For Medi Cal

If you do not we will not be able to determine your eligibility or process payments which can lead to a Pending claim status.

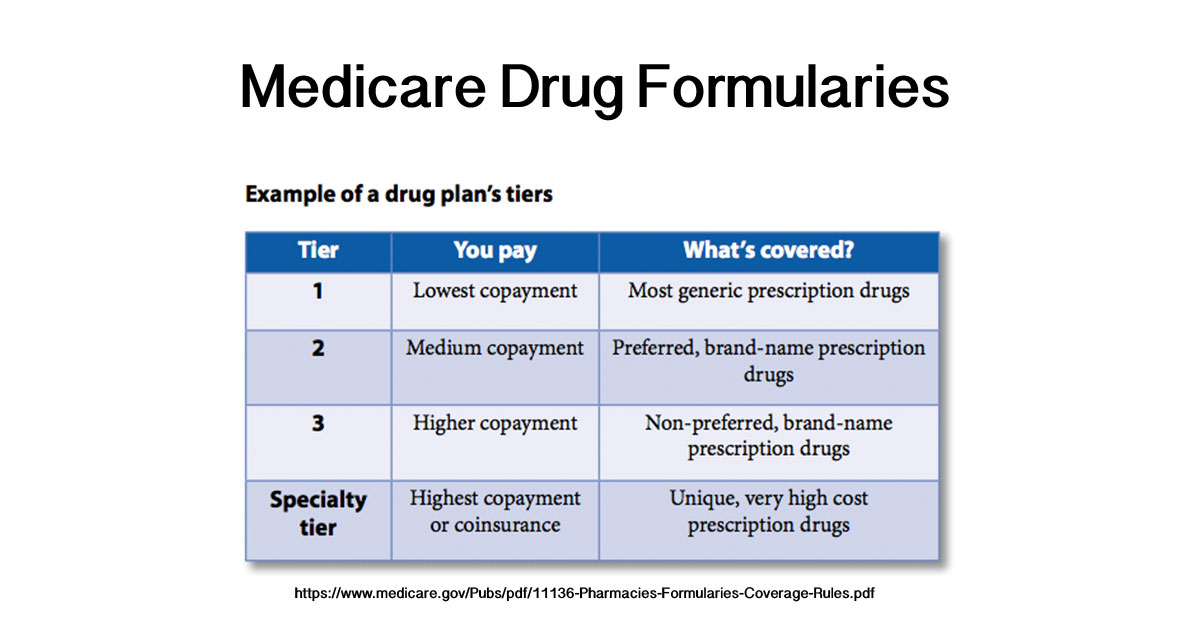

Why am i not eligible for covered california. You could even qualify for low-cost or free health coverage through Medi-Cal. If you currently have a Covered California plan and become eligible for premium-free Medicare Part A hospital insurance you can keep your current Covered California plan but you will have to pay the full cost. If you have an existing Pandemic Unemployment Assistance claim you do not need to.

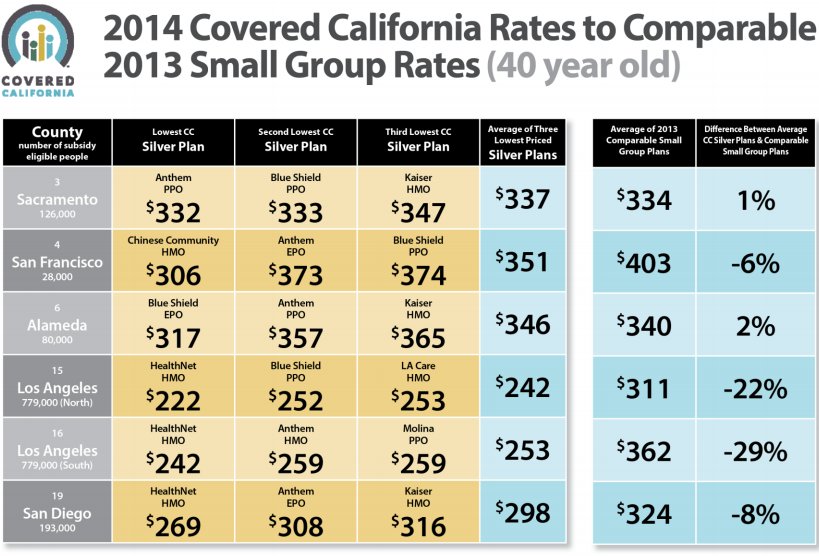

Medi-Cal Eligibility and Covered California - Frequently Asked Questions. You have at least one but no more than 100 eligible employees and meet certain contribution and participation. Back to Medi-Cal FAQs 2014.

To appeal a decision you dont agree with contact Covered California in one of these ways. To learn more visit Benefit Year End. That leaves about 11.

Under federal law if you are currently enrolled in or are eligible for Medi-Cal you are ineligible to purchase subsidized coverage through Covered California. Employer Health Insurance that is not Affordable If the health plan offered at work doesnt pass the employer sponsored affordability test then you may qualify for a subsidy through Covered California. Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

When applying remember that family members who are not lawfully present are not eligible for Covered California health plans but may be eligible for Medi-Cal. Immigrants who are not lawfully present do not qualify for a health plan through Covered California. Immigrants who are not lawfully present can also buy private health insurance on their own outside of Covered California.

If you are eligible for Medi-Cal you can still purchase a health coverage plan through Covered California but you cannot receive premium assistance to reduce its cost and will have to pay the full cost of the Covered California. You can file an appeal. The majority of our customers get financial help.

However they may qualify for coverage through Medi-Cal up to age 19 or for pregnancy coverage. Waiting or Probationary Periods. Can anyone get Covered California.

Roughly 3 million people are uninsured in California but about 60 of them are not eligible for insurance through Covered California because they are undocumented immigrants. Learn more about who qualifies for a subsidy. That means you can earn no more than 134960.

Situations that fit the scenarios below may be eligible for a subsidy through Covered California. If you do not find an answer to your question please contact your local county office from our County Listings page or email us. You must report your Medicare eligibility to Covered California within 30 days of becoming eligible.

You have at least one employee who receives a W-2. You can call Monday through Friday 8 am. However they can still apply through Covered California to see if they may be eligible to receive low or no-cost coverage through Medi-Cal.

An immigrant who is not lawfully present can apply for a. You are eligible for Covered California for Small Business if. Noncitizens that are not lawfully present you can still apply for health care through Covered California.

See If Youre Eligible for Financial Help. Immigrants not considered to be lawfully present do not have to pay a tax penalty if they do not have health insurance. These programs are not insurance plans and do not provide full coverage.

If you do you are not eligible for a subsidy. Call Covered California at 1-800-300-1506 TTY. What if I dont agree with the decision Covered California makes.

Back to Medi-Cal Eligibility. County health programs are commonly known as county indigent health or programs medically indigent adult programs. So lets say youre a family of six.

And Saturday 8 am. Even if youve checked before check again because more than a million people could see more savings. Additionally Covered California encourages anyone who is lawfully present to apply for health insurance even if some of their family members are undocumented.

Additionally some counties offer other. If you do not find an answer to your question please contact your local county office from our County Listings page or email us at Medi-Cal Contact Us. In order to be eligible for assistance through Covered California you must meet.

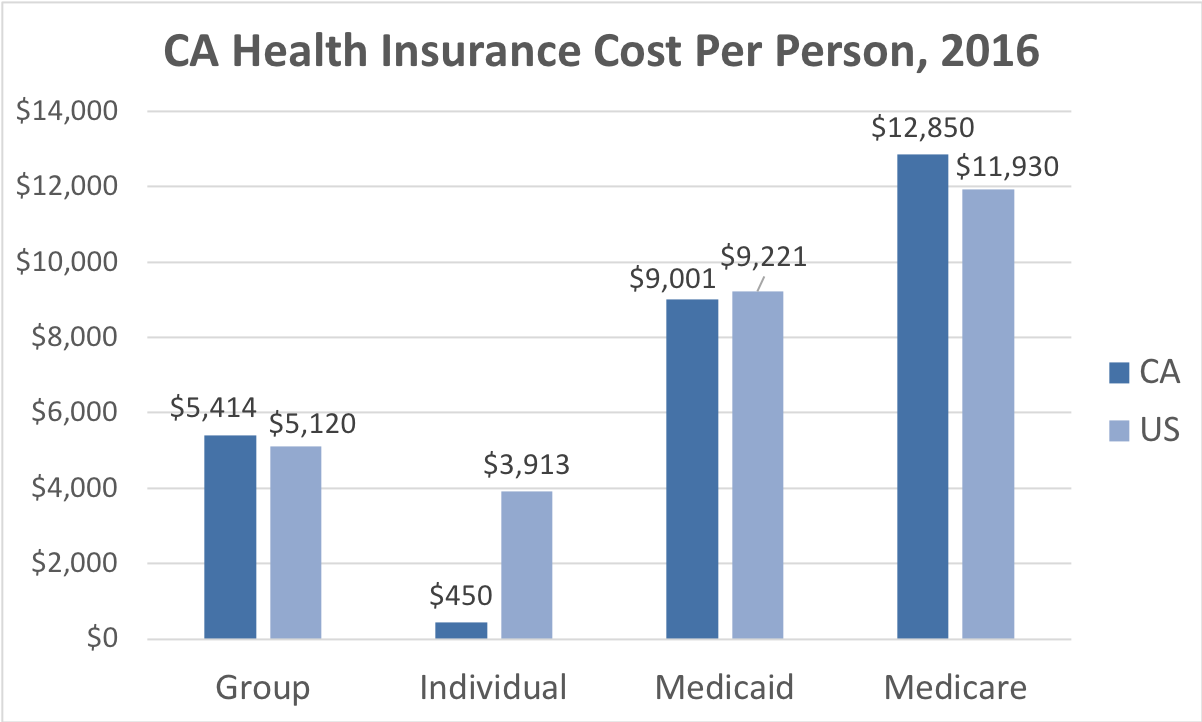

Families with mixed immigration status. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. Immigrants who are not legally present may apply for medical coverage through Covered California on behalf of their lawfully present family members including children.

Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. To qualify for government subsidies you must purchase your coverage through Covered California and your annual gross income cannot be more than 400 percent of the FPL. Not eligible to purchase a Covered California Health plan.

If you are uninsured and are not eligible for Medi-Cal or a plan through Covered California you may qualify for limited health services offered by your county. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)