The three biggest pathways to coverage are Medi-Cal premium assistance and cost-sharing reductions. California health insurance plansChoose between all the different health insurance.

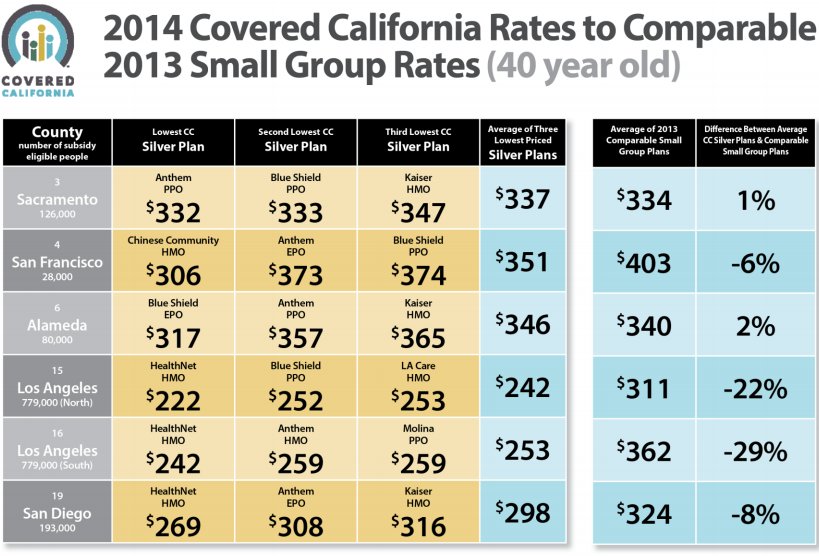

California Health Insurance Premiums Under Obamacare Revealed Huffpost

California Health Insurance Premiums Under Obamacare Revealed Huffpost

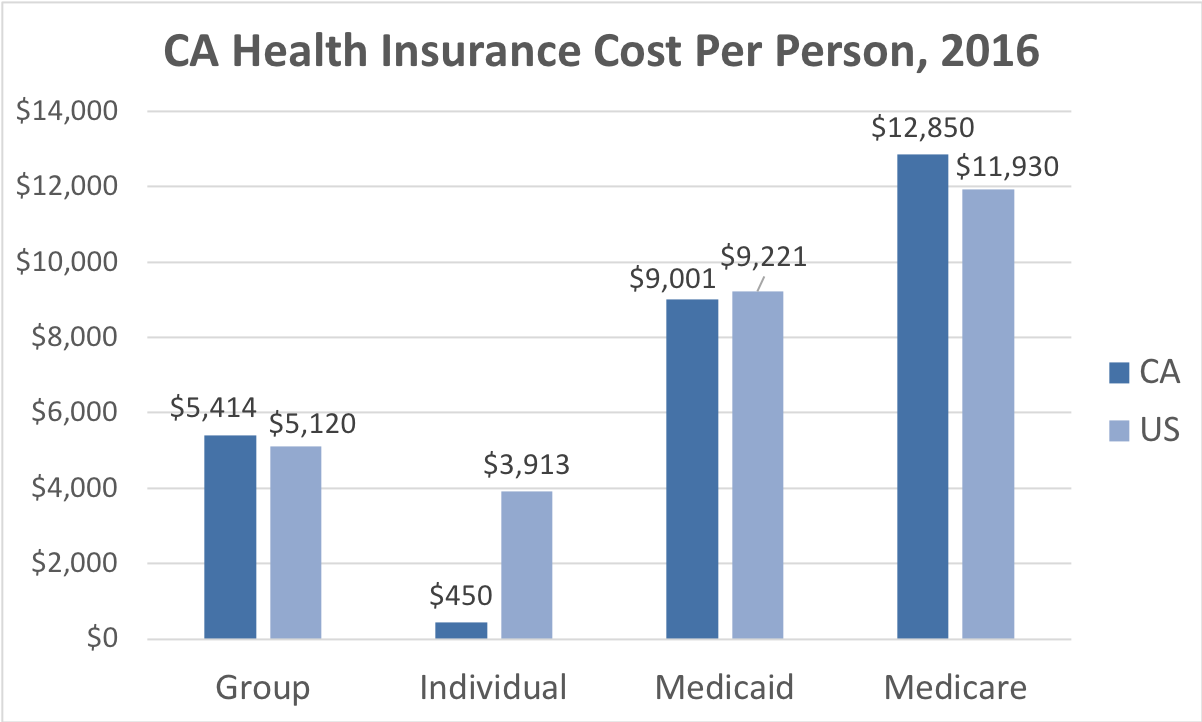

For the 2021 plan year the average monthly cost of health insurance in California is 546 for a 40-year-old.

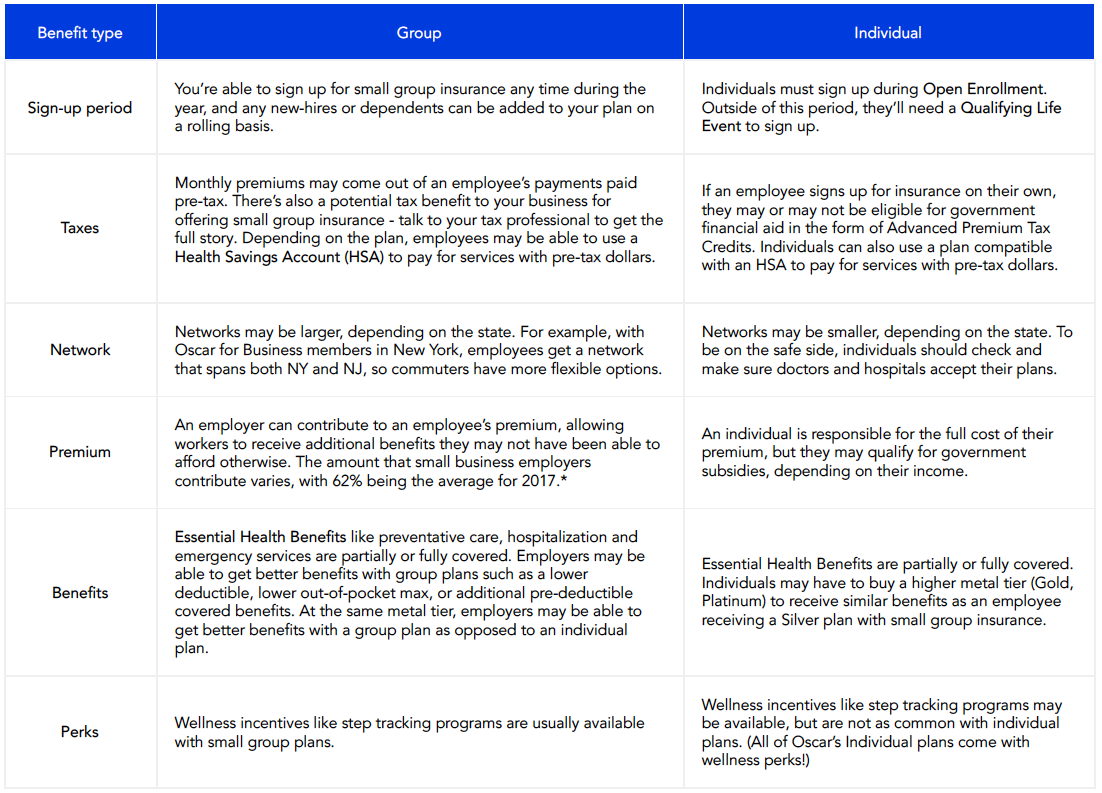

Low cost health insurance california individual. To qualify for this coverage level you must be under 30 years of age or 30 years of age or older with an approved hardship exemption from Covered California. UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors. In the past insurers would price your health insurance based on any number of factors but after the Affordable Care Act the number of variables that impact your health insurance costs decreased significantly.

Health insurance is never really free and is rarely truly low-cost. Similar exemptions apply depending upon the policy which is bought. If you qualify for this sort of subsidizationusually from an employer or the governmentthis is a great way to obtain health.

Your household size and income not your employment status determine what health coverage youre eligible for and how much help youll get paying for coverage. This article provides basic information on health insurance in Southern California and then the link at the end where you can get low cost health insurance quotes instantly from California. 52 Zeilen California Health Insurance.

In 2020 individual health insurance premiums averaged around 623 per month in the United States leaving many people to wonder whether affordable health insurance plans exist. Anthem Blue Cross Blue Shield California Kaiser Permanente. Nothing is more important than the health of you and your family.

You may also qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program CHIP. From Los Angeles to San Francisco San Diego to Sacramento explore these California health insurance options and more that may be available now. With eHealth you can search the largest selection of plans available online using helpful comparison tools empowering you to find insurance.

A minimum coverage plan is a high-deductible low monthly payment option to protect you during serious health crises. Average Health Insurance Cost in California The average cost of health insurance in California is 5799 a year. Annual deductibles range from 75 to 7900 for an individual plan and 150 to 15800 for a family plan.

Health insurance basics explore the basics of individual and family health insurance plans. That means insurance costs may vary widely. See if you qualify for a minimum coverage plan.

In 2021 the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is 495. Low-income families and individuals in California have several options for finding affordable health insurance. Californias low cost automobile insurance policies satisfy the states liability insurance.

Premium costs are based on factors such as age lifestyle gender public health issues prevalent in your state and the plan you choose. Thats why Progressive Health by eHealth makes searching for individual and family health insurance plans so simple. Affordable individual and family health insurance plans.

California Health Insurance- Individual And Family We offer only quality individual and family California health insurance plans with affordable prices from all the major California health insurance providers. Currently the cheapest health insurance you can get is Medicaid because it provides free or low-cost coverage to those who qualify. The cheapest health insurance in California starts for as low as 167 per person for major medical plans.

Before exploring your options for free or low-cost health insurance understand one thing. Health insurance for individuals who are 65 or older or those under 65 who may qualify because of a disability or another special situation. Someone is subsidizing the monthly premiums so that youre not paying the full cost yourself.

The california low cost automobile insurance program lca was implemented in 2000 by the california legislature to address the problem of uninsured motorists in the state. You can buy an individual policy from an insurance company a licensed health insurance agent or from Covered California- Californias Healthcare Marketplace. Founded in 1997 LA.

Care Health Plan serves over two million members with nearly 2000 employees. Start your search for low-cost health insurance today. Health insurance thats free or low-cost to you means one of two things.

Find low cost insurance in Southern California health individual quotes online. If you just lost your job and your job-based insurance. Personal Health Insurance Plans.

You may also be eligible for a catastrophic coverage plan if you are under 30. Types of plans offered in California include major medical health insurance coverage such as Personal Health Quotes Family Health and Group Health. In California cheap health insurance can be purchased through the online state insurance exchange or acquired through Medicaid if your household income falls below 138 of the federal poverty level.

/Understanding-acupuncture-for-depression-4770157-V2-fab0986399b746d6b0e856a88e357468.gif)