Medicare usually covers emergency dental procedures that require a hospital stay or complex surgeries that require dental exams. Medicare usually only pays for vision exams or eyewear related to specific illnesses or surgeries such as those related to cataracts diabetes or macular degeneration.

How To Get Medicare Dental Vision Coverage Aarp Medicare Plans

How To Get Medicare Dental Vision Coverage Aarp Medicare Plans

Just like dental insurance you may choose your own eye doctor.

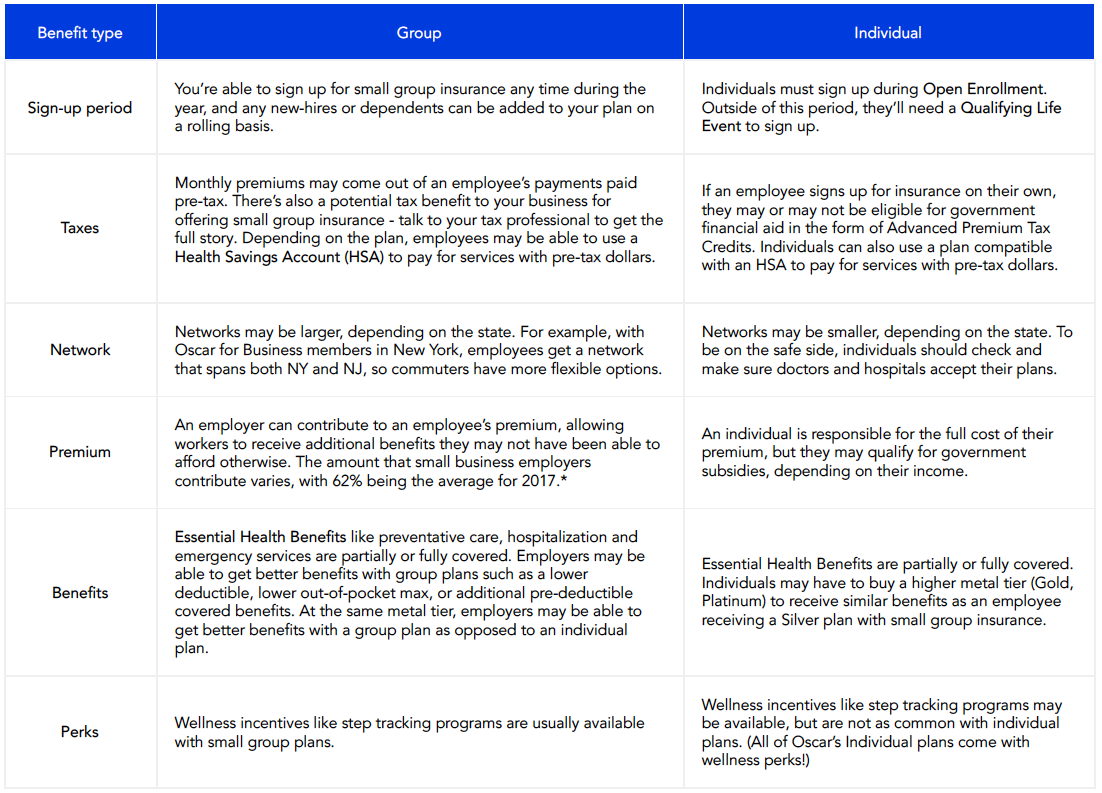

Medicare supplement plans that include dental and vision. Medicare Advantage plans are offered by private insurance companies. Additionally if youre eligible for both Medicaid and Medicare some dental costs including dentures are also typically. Many plans also include other coverage such as dental vision and hearing According to the Kaiser Family Foundation KFF a non-profit organization focusing on national health issues 67 of.

Explore vision dental and fitness coverage options with Humana Medicare Advantage plans Many Humana Medicare Advantage plans include routine dental vision and fitness coverage. To help you manage your costs for more serious procedures we offer a broad range of optional supplemental benefits OSBs for an additional monthly premium. There are even dental and vision insurance packages that offer benefits for both.

There are still options for people on Medicare to obtain specific benefit packages to help save on vision dental and hearing services. Dental benefits Network plans cover preventive care 100 such as oral exams cleanings and X-rays Some plans include comprehensive services such as fillings and extractions. There are separate standalone plans for vision or dental benefits that can be used on top of a health insurance plan as a form of supplemental insurance.

Purchasing a Medicare Advantage Plan is often a good way to get dental coverage so consider only plans that include dental or you will need to purchase separate individual dental insurance. Get coverage on eye exams eyeglasses and contact lenses with this combined plan. Members will pay out of pocket and then submit to get reimbursed up.

Medicare Supplement plans aka Medigap plans do not provide any additional dental or vision coverage. DMR plans cover most ADA dental codes including preventive care and comprehensive services. Because Original Medicare Part A and Part B provide coverage for care that is medically necessary they do not help pay for routine vision and dental care such as regular examinations teeth cleanings or fillings tooth extraction eyeglasses or contact lenses.

You will need additional vision insurance outside of basic Medicare to help pay for your regular eye exams glasses lenses and contacts. But not all vision and dental care is routine. Dental Vision and Hearing Benefits Medicare beneficiaries usually find themselves without dental vision and hearing benefits when they are no longer part of an employers policy.

Check with your plan carrier to learn more about the terms of your Medicare Advantage plan vision coverage. Most also include prescription drug coverage as well as other benefits such as hearing health coverage and gym memberships. Picking the right Medicare insurance is essential to make sure you have the coverage you need moving forward.

These plans provide coverage for what Medicare does not cover in full such as the deductibles and copays 20 Medicare does not cover. Medicare Advantage Plans may offer extra coverage like vision hearing dental andor health and wellness programs. If you want dental coverage consider Medicare Advantage plans.

This Dental plan also includes Vision and Hearing benefits. Medicare Advantage Part C plans can offer coverage for dental and vision health items in addition to also offering the same coverage as Original Medicare. Medicaid provides vision and dental benefits for children in all states.

In 2016 the Part B premium is 10490 each month. While Medicare Supplement Insurance Medigap and Original Medicare Medicare Part A and Part B do not cover routine dental and vision care Medigap plans can help beneficiaries pay for costs they may face if they get dental or vision care that are covered by MedicareThere are also other types of Medicare plans called Medicare Advantage plans that may provide routine dental and vision. Medicare Supplement Insurance also called Medigap does not provide coverage for dental or vision care.

Most include Medicare prescription drug coverage Part D. However there are several insurance companies that offer discounts on dental and vision services if you buy a Medigap plan from them. Part C offers additional benefits that Original Medicare wont cover like dental vision or hearing.

Routine vision exams may help in maintaining good overall health and recognize any problems that can lead vision complications. Do Medicare Supplement plans cover dental and vision care. It is important that you contact your provider before you settle on a plan.

Generally they dont add any additional coverage. If you are looking for dental vision and hearing insurance you should consider a Medicare Advantage plan. Medicare Advantage Plans also known as Medicare Part C provide an alternative to Original Medicare.

Among Medicare beneficiaries who use dental services 19 spent more than 1000 on out-of-pocket expenses for a year8 If you have Medicare. The good news is there are a few situations where Medicare A or B will help you out with dental or vision needs. These plans which are provided by independent health insurers often include vision coverage in addition to coverage for dental prescription drugs and more.

Instead these plans provide coverage for some of the out-of-pocket costs associated with Original Medicare. Original Medicare only includes Part A hospital coverage and Part B doctor coverage but Medicare Advantage plans also called Part C generally include dental benefits vision benefits hearing benefits prescription drug coverage and more. How can those with Original Medicare get dental coverage.

In addition to the Medicare Part B premium people typically pay a monthly premium for the Medicare Advantage Plan. Your Original Medicare insurance Parts A and B or Medicare Advantage Plan.

/Understanding-acupuncture-for-depression-4770157-V2-fab0986399b746d6b0e856a88e357468.gif)