Your monthly premiums will be higher and your copays for office visits will also cost more. This supplement may be referred to as the OneNet Physician Health Care Practitioner.

Hdhp Vs Ppo What S The Difference

Hdhp Vs Ppo What S The Difference

With that in mind Im torn between going for the PPO which has OON coverage or the EPO which doesnt.

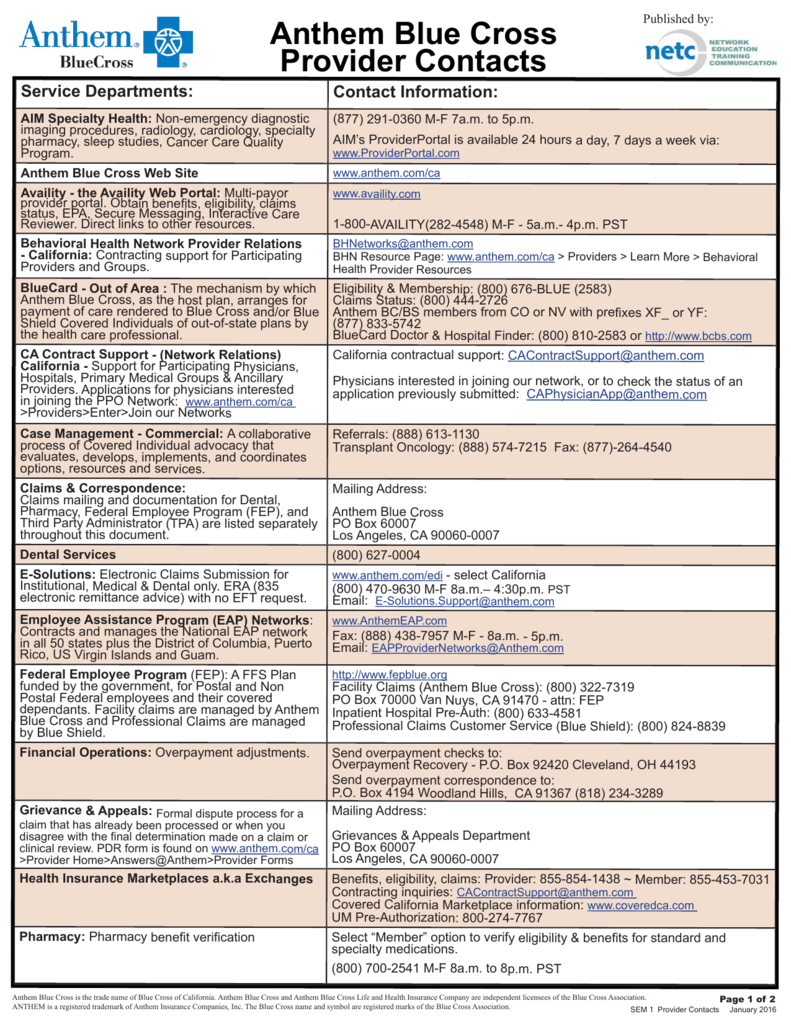

Ppo next insurance. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network. OneNet PPO LLC OneNet is a wholly owned subsidiary of UnitedHealthcare Insurance Company a part of UnitedHealth Group Incorporated. A Health Insurance Specialist provides health life medicine prescription insurance dental insurance long-term care hospital hospital stay surgery deductible co-pay co-insurance pre-existing conditions HMO PPO policy insurance policy policy holder disability short term.

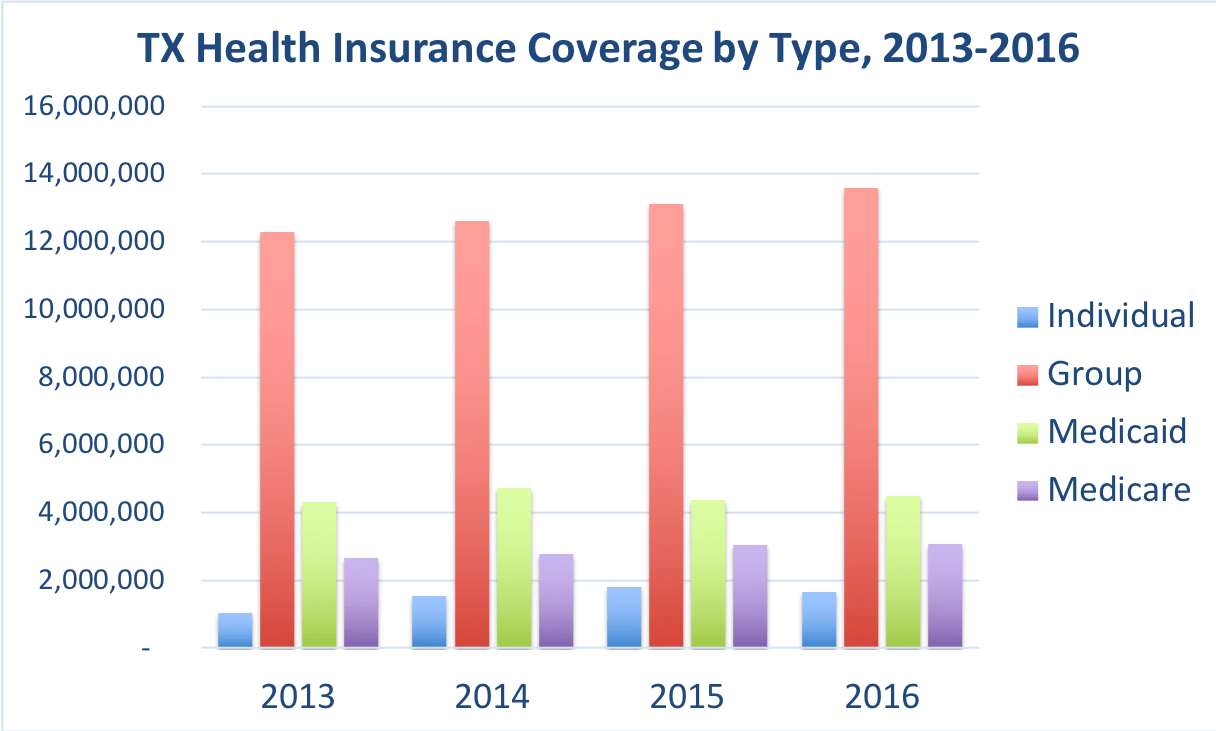

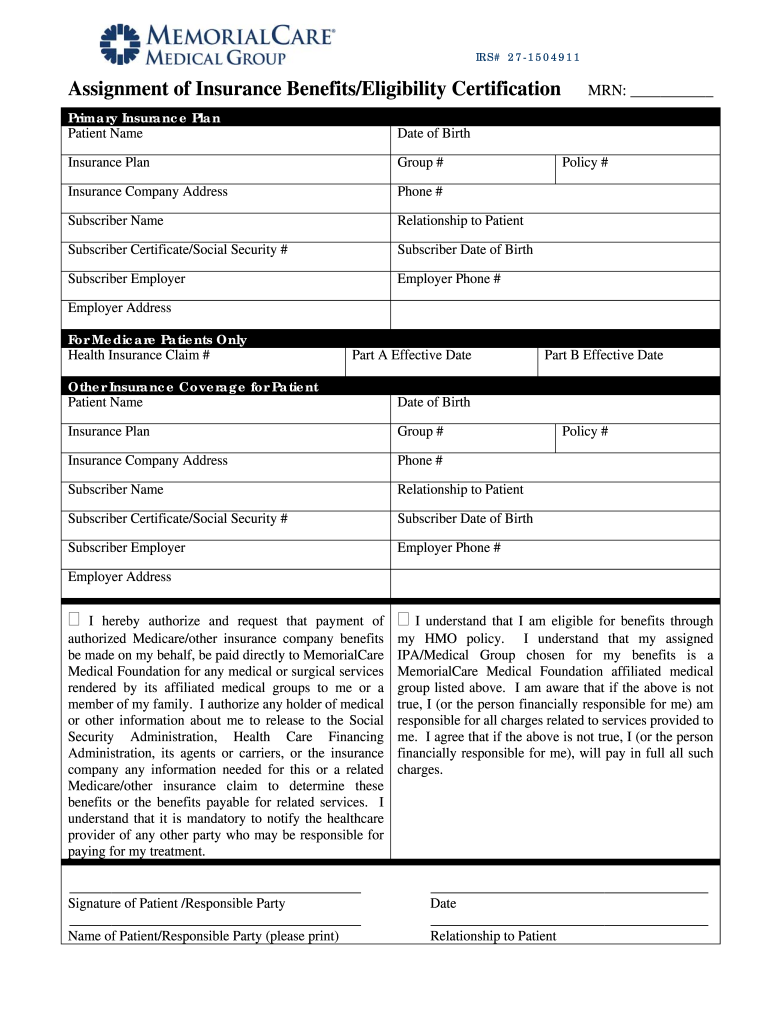

A PPO is a group of medical providers think doctors hospitals specialists therapists that partner with an insurance company. De Insurance Academy van het Verbond van Verzekeraars ontwikkeld. Medicare HMO PPO.

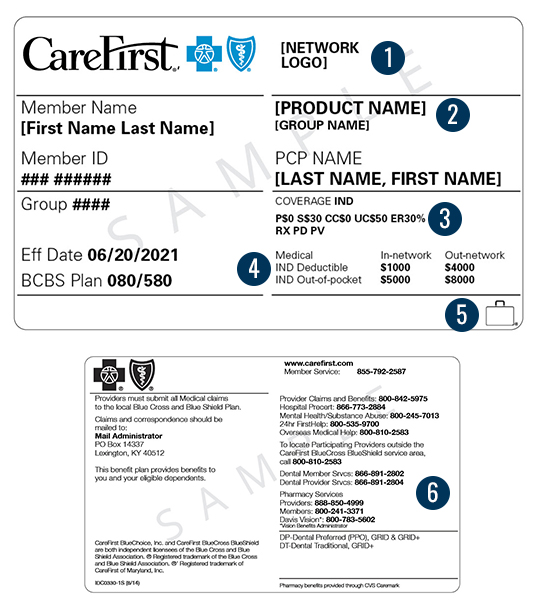

Most insurance companies whose products we offer have a provider network PPO network. Advertentie NIBE-SVV de opleider voor de financieel dienstverlener. PPO which stands for Preferred Provider Organization is defined as a type of managed care health insurance plan that provides maximum benefits if you visit an in-network physician or provider but still provides some coverage for out-of-network providers.

Next Insurance policies include all the coverage you need with no extras that only add to your costs. Typically PPO insurance will offer cheaper costs if you use providers within the network. The OneNet supplement is a supplement to this UnitedHealthcare Guide both of which OneNet health care providers must follow.

A preferred provider organization or PPO is a health or dental insurance plan that contracts with hospitals and doctors to create a network of coverage. A PPO preferred provider organization is a type of health insurance plan that offers you a network of doctors and hospitals for care but doesnt require you to choose a primary care physician PCP. A PPO health insurance plan provides more choices when it comes to your healthcare but there will also be higher out-of-pocket costs associated with these plans.

Book an appointment with one online today. Regardless of the plan design out-of-network providers are not bound by any contracts with your health insurance company. Services Ppo Next offers Health Insurance in Long Beach CA.

De Insurance Academy van het Verbond van Verzekeraars ontwikkeld. NextBlue of ND Plans are built for North Dakotans so you can get the coverage that meets your unique needs like the Classic PPO plan with a 0 premium and the Premium PPO plan with a 69 premium. 27F NY Oxford no dependents.

This means auto insurers and reinsurers need to invest for a liability profile with characteristics very different from the typical motor insurance liability. The key differences are. These providers offer their services to the insurance plans members and subsequently the insurance company reimburses them predetermined rates.

In addition Next Insurance provides free unlimited certificates of insurance 247 online. PPOs are a series of regular compensation payments for the most serious insurance claims rather than a distribution of funds via a single lump sum. Steward Health has PPO Next Insurance providers.

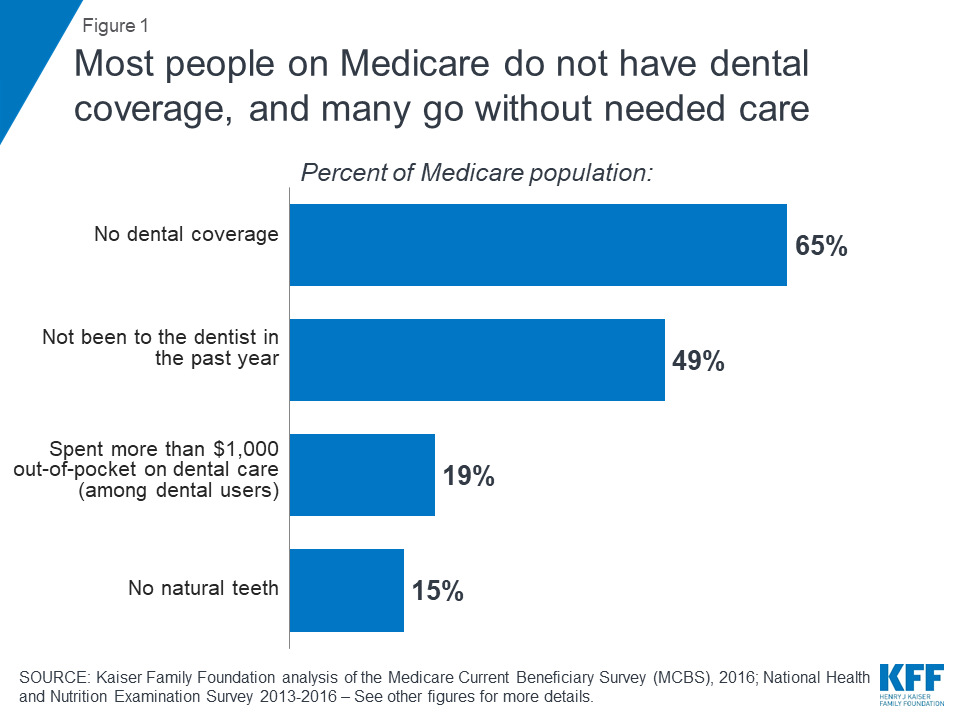

Advertentie NIBE-SVV de opleider voor de financieel dienstverlener. Im pretty healthy but I am expecting to have a surgery done sometime early next year. Medicare also has both PPO and HMO options.

Even if your POS or PPO insurance pays a portion of the cost the medical provider can bill you for the difference between their regular charges and what your insurance pays. PPO stands for Preferred Provider Organization and has the directory of providers that have a relationship with the PPO provider. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care.

You will pay the lowest prices if you go to in-network health care providers but PPOs usually still cover some out-of-network costs. De leergang is ism. However you can still go to out-of-network doctors but can expect to pay an additional cost for coverage.

De leergang is ism. The PPO premium is 298 biweekly 0 deductible 3000 max. Im choosing my plan for next year and would like some advice.

PPO stands for Preferred Provider Organization. Both include prescription drug coverage Part D plus multiple supplemental benefits like routine vision and dental hearing aid coverage Silver Sneakers and world-wide travel coverage. The link to the provider network is provided next to that products details.

/best-health-insurance-companies-4174511-Final-1f8530aaf0594ee79c9d545ed66627d0.png)