The type of plan you have HMO PPO etc. A PPO might say it covers 60 percent.

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

The differences besides acronyms are distinct.

How to tell if my insurance is hmo or ppo. PPOs mean you pay less for covered services when you use providers in your plans network aka preferred providers. If you obtained the coverage through the Federal Marketplace their customer service should be able to tell you what plan you have as well. Compared to PPOs HMOs cost less.

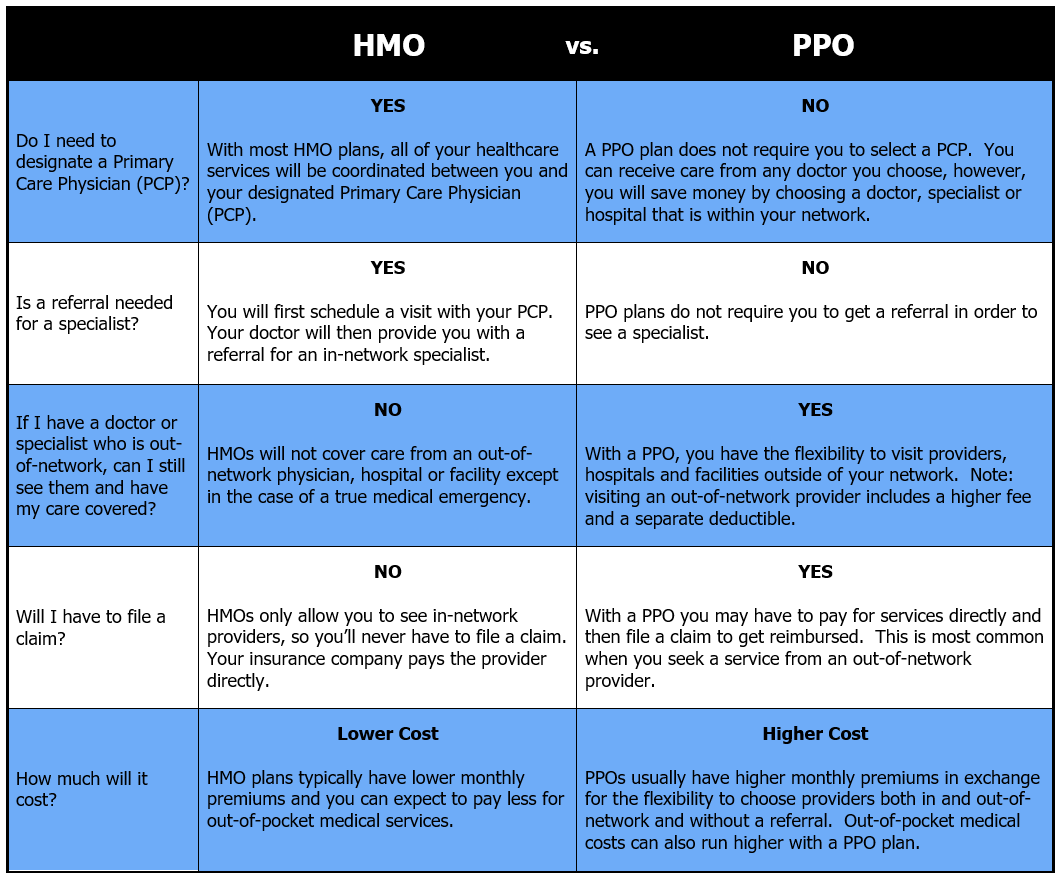

Your medical coverage code is made up of numbers. The big difference between HMO and PPO for many individuals and families is the primary care doctor. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage.

With an HMO you will have a primary care doctor. The cost of the plan. Many fillings crowns and just general tooth restoration.

The name of your insurance company and contact information such as a customer service phone number email address and website. If you come across 1 million thats a little skimpy. If you have an insurance card or certificate of insurance it should say on there.

An HMO is more likely to have a plan that provides maternity coverage but not all do. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. What are the differences between HMO and PPO plans.

The coverage for out-of-network services. HMO which literally does not cover any percentage of root canals or crowns. However PPOs generally offer greater flexibility in seeing specialists have larger networks than HMOs and offer some out-of-network coverage.

It really depends on a person situationThings like the person healthcare usage budget doctors and tolerance for out of. To me a PPO costs more a. The major differences between HMO vs PPO plans can be found in the.

Your name and the name s of any dependents covered by your policy. Choosing between an HMO or a PPO health plan doesnt have to be complicated. A PPO or Preferred Provider Organization is typically the most popular type of plan for anyone getting their insurance through their employer.

The ability to see specialists without referrals. Size of the network. Im looking to get my own individual plan but dont really get what the benefit of a PPO is versus an HMO.

Usually HMOs also have no lifetime limit on payments for health care. You can call the customer service for the Carrier that you have insurance through. Your medical coverage code is made up of numbers and the Akamai Advantage logo appears at the bottom left corner of your HMSA membership card.

Unfortunately this question is not so straight forward. While were using common terms and definitions here be aware that terms and definitions may vary by insurance company. HMO or Health Maintenance Organization.

You can still use out-of-network providers but you will almost always have to pay more though not necessarily 100 like with an HMO. PPO Health Insurance Plans. With an HMO plan in most cases you must see a provider or primary care physician PCP within your network.

It is also likely to be more generous in providing preventative wellness checkups. Currently on my parents dental insurance Humana. You can also Google the carrier plan name and number and it will tell you.

If youre not sure if your health insurance makes you eligible for an HSA read the policy for coverage details or contact your insurance company. I had to dish out 2000 for one recently and cant afford to keep that up. The simplest answer is to review your health insurance contract look on your benefits card or most insurance agents can tell you if you give them the Carrier state and plan name.

If the insurer cant confirm that your plan is. The size of the in-network. Essential Advantage HMO HMSA Akamai Advantage.

In 2018 the average PPO cost 3019 annually compared to an HMO which cost 2764 annually. The monthly payment for an HMO plan is lower than for a PPO. PPO and Indemnity always have a lifetime limit typically 2 million up to as high as 8 million.

If you are the dependent on someone elses policy their name will probably be on your card. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment.

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

How Do I Determine My Medical Plan Type

How Do I Determine My Medical Plan Type

You Re Aging Off Of Your Parents Health Insurance Plan Now What Thinkhealth

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

How Do I Determine My Medical Plan Type

How Do I Determine My Medical Plan Type

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Difference Between Hmo And Ppo Difference Between

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.