This might be different from the policy owner who may have purchased the policy on the insureds behalf. Combines life insurance protection with tax-advantaged investment options enabling employees to grow their savings.

Don T Rely On Group Insurance Get An Individual Life Insurance Policy

Don T Rely On Group Insurance Get An Individual Life Insurance Policy

Group Insurance Our Group Insurance Benefits help you your employees and their beneficiaries by reducing the financial impact of unexpected life-changing events that could leave them without an income because of critical illness disability or death.

Group life policy. Check Help your employees be financially prepared for events that could change their lives. Group life insurance is a type of life insurance coverage in which a group is the master policyholder of an insurance contract and certificates of insurance are issued to participating individual members. THE DIFFERENT TYPES OF GROUP LIFE ASSURANCE.

A business can set up a group policy that pays a lump sum benefit for dependants and relatives after the death of an employee partner or LLP member in three different ways. Group life insurance also called group term life insurance is a popular benefit offered by many employers. Group Variable Universal Life GVUL.

According to the Bureau of Labor Statistics BLS in 2020 60 of non-government workers had access to employer-provided life insurance and 98 of. With every group Life insurance policy. Group Universal Life GUL.

Group life insurance shows employees you value what matters most to themtheir loved ones. Schedule of Basic Life Insurance Supplemental Life Insurance - Premium Schedule see COMPTROLLERS MEMORANDUM NO. Group life insurance is a type of life insurance in which a single contract covers an entire group of people.

The terms of the Policy supersede any discrepancy. These insurance policies are most commonly offered by employers to their employees as a free or optional benefit. Annuity life insurance policy definition whole life insurance policy definition group life insurance definition permanent life insurance policy definition group life insurance policy example industrial life insurance policy definition group term life insurance definition life insurance group policy Conclusion Bankruptcy prevents a lawyer who support can alleviate their lives this path.

These are commonly asked questions about beneficiary designations under the Group Life Insurance Policy currently administered by The Standard. Group term life insurance definition what is group life insurance group term life calculator basic group term life insurance term life insurance for seniors life insurance group policy term life insurance policy rates voluntary group term life insurance Enjoy a mandatory mandatory financial information employment factors. It does not search group life policies ie policies provided through employment.

Offers life insurance protection along with a tax-advantaged saving option that allows employees to. Many employers offering employee benefits consider group term life insurance an essential part of their benefits package. Back to Healthcare Policy and Benefit Services Division Index for Employees.

Of individual life insurance policies. By 2016 Lincoln now called LNC Lincoln National Corporation had divided its operations into four business segments. These employer-provided life insurance policies are sometimes referred to as basic group.

Many employers offer free life insurance as a benefit. Group life insurance Help protect your employees and their families with Principal life insurance. An employer-financed retirement benefits scheme EFRBS.

2004-23 Excerpts from the General Statutes of Connecticut Pertaining to Group Life Insurance for Permanent State Employees. The whole company had consolidated assets under its management of over 262 billion and shareholders equity of over 15 billion. Life insurance annuities retirement plan services and group protection.

A policy covering registered scheme benefits. Typically the policy owner is an employer or an entity such as a labor organization and the policy covers the employees or members of the group. Please tell us about the person whose life is insured under the policy.

The Standard administers claims for life insurance benefits in accordance with the Policy terms and makes the ultimate decision on claim payments. Group term life insurance may be extended to the spouse and minor children of insured employees of the United States government providing that the policy constitutes a part of the employee benefit program and the spouse or children of. Group life insurance is often provided as part of a complete employee benefit package.

This provides an additional benefit to help pay for expenses associated with transportation of the body of an eligible deceased employee.

What Is Group Life Insurance Www Policy Com

What Is Group Life Insurance Www Policy Com

Group Life Insurance All You Need To Know Moneyvisual

Group Life Insurance Policies Truelifequote

Group Life For A Growing Business How Employee Benefits Can Affect You

Group Life For A Growing Business How Employee Benefits Can Affect You

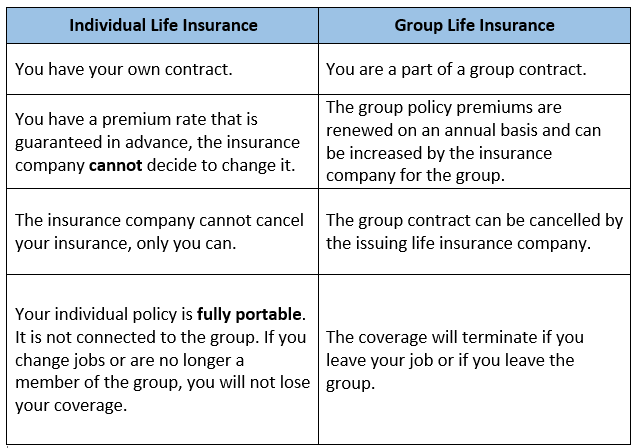

Group Life Vs An Individual Policy Which One Is Right For You N Ville Insurance Group

Group Life Vs An Individual Policy Which One Is Right For You N Ville Insurance Group

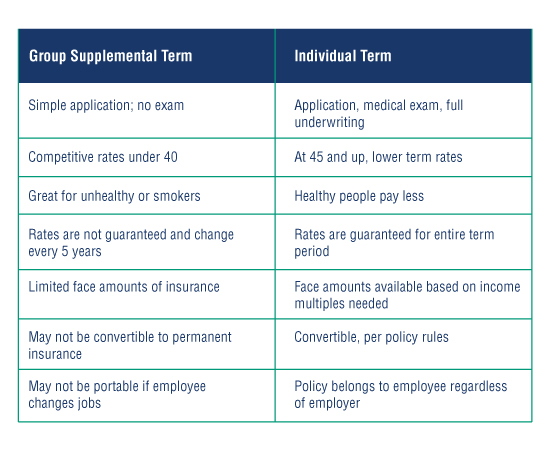

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

7 Important Facts To Consider About Group Life Insurance Policies Investment Professor Com

What Is Group Life Insurance Human Resource Management

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

Business Life Insurance Find Group Coverage Today Trusted Choice

Business Life Insurance Find Group Coverage Today Trusted Choice

Group Life Insurance Definition

Group Life Insurance Definition

Group Life Insurance For Employers Cigna

Group Life Insurance For Employers Cigna

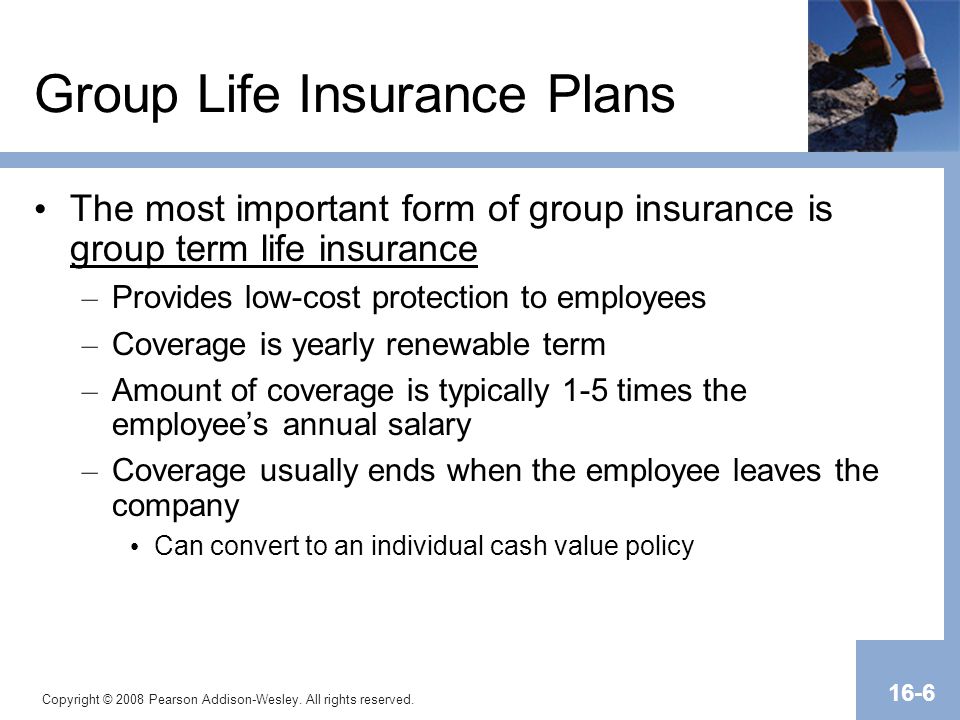

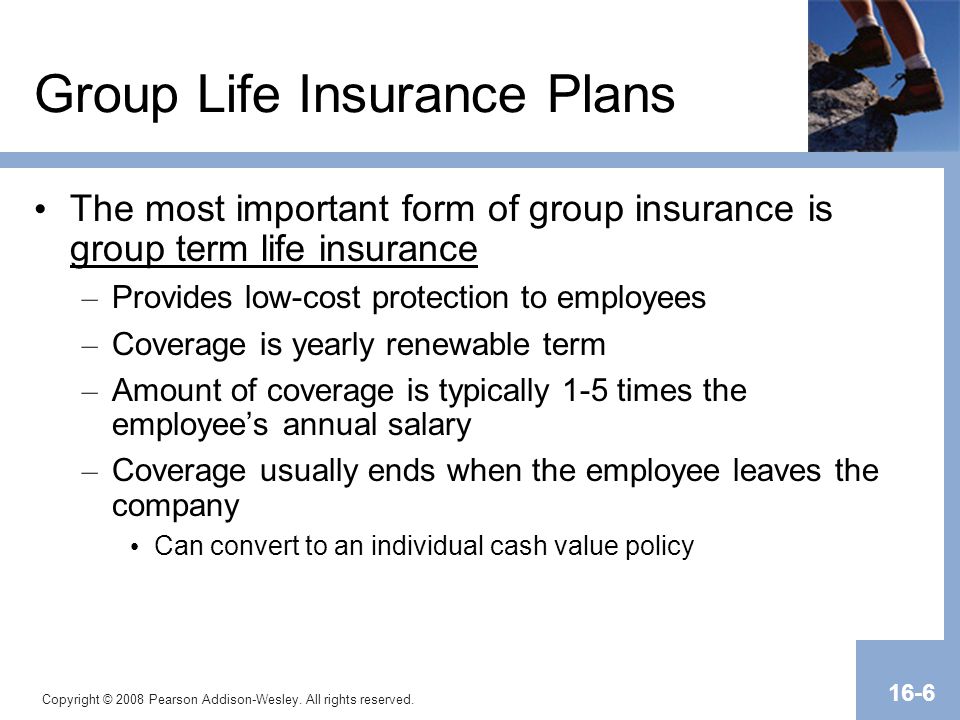

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Ncflex Group Term Life Insurance Youtube

Ncflex Group Term Life Insurance Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.