But the Value plan has a 445 deductible on all other tiers. However the Plus plan has a broader range of drugs.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Shop 2021 Medicare plans.

Medicare plan with no deductible. The standard monthly premium for Medicare Part B enrollees will be 14850 for 2021 an increase of 390 from 14460 in 2020. Medicare supplemental Medigap Plans F and G can be sold with a high deductible option. The big decision for the Medicare beneficiary is if they should select a PDP with a lower premium and 310 deductible or pay a higher monthly premium for a no deductible plan.

The high deductible version of Plan F is only available to those who are not new to Medicare. Some Medicare Advantage plans have 0 annual deductibles. For all plans youll be responsible for out-of-pocket payments including a premium and deductible.

MSA plans dont offer Medicare drug coverage. You can use the money to pay for your health care services during the year. The Medicare Part D deductible is the amount that you will pay each year before your Medicare plan pays its portion.

A small percentage of people will pay more than that amount if reporting income greater than 88000 as single filers or more than 176000 as joint filers. In 2021 thats 445. Many different Medicare Part D plans are available the specific plans and costs depend on your location.

Coinsurance is usually a percentage and a copayment is a set dollar amount. 04162020 4 min read. I take a lot of generic prescriptions.

If you want drug coverage you have to join a Medicare Prescription Drug Plan. A plan determines which medications are subject to its. As mentioned above some Medicare Advantage plans have no deductible and some plans even offer 0 monthly premiums.

Last Updated. The Medicare Part B deductible in 2021 is 203 per year. Medicare sets the standard deductible every year.

Shop 2021 Medicare plans. The 0 deductible plans allow members to start paying copayments for prescriptions right when the plan. Extra cost no benefit for 0 deductible PDPs.

In 2020 the maximum Part D deductible is 435 but depending on where you live you may find a plan with a lower deductible or even no deductible at all. The Centers for Medicare and Medicaid Services CMS sets the maximum Medicare Part D deductible each year. Some drug plans charge a 0 yearly deductible but this amount can vary.

Part D plans with a deductible usually have a lower monthly premium than plans that have no deductible. You must meet this deductible before Medicare pays for any Part B services. Look at Medicare drug plans with Tiers that charge you nothing or low copayments for generic prescriptions.

Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. Medicare Supplements Medicare Supplement or Medigap insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. Medicare deposits money into the account usually less than the deductible.

It covers medical treatments and comes with a monthly premium of 14850 in 2021. The last one Medical Savings Accounts MSAs are another type of Medicare Advantage plan with no monthly premium. Before you decide on a Medicare Part D plan gather a list of any medications you take and the dosage.

Explore your Medicare enrollment options. Medicare Advantage plans out of pocket cost. Annons Protect the best years ahead.

The Value policy has no deductible on the first two tiers at preferred pharmacies. The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020. Plans can have no deductible or any amount up to the standard amount.

Many Medicare Advantage plans have a 0 monthly premium. The Plus Plan has a deductible of 445 that applies to all tiers. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses.

CoinsuranceCopayment Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Annons Protect the best years ahead. Get advice from our licensed insurance agents at no cost or obligation to enroll.

Medicare Part B Costs in 2021. If you have further questions about the Medicare Part B deductible or any other costs associated with Medicare explore our guide to Medicare costs. Look at drug plans with no or a low Deductible or with additional coverage in the Coverage gap.

Want to sign up for a Medicare Advantage plan. They can offer coverage for some of the expenses youll have as a Medicare beneficiary like deductibles and coinsurance. Unlike the Part A deductible Part B only requires you to pay one deductible per year no matter how often you see the doctor.

Get advice from our licensed insurance agents at no cost or obligation to enroll. Part B is considered your medical insurance. Is it possible to get an affordable health insurance plan with no deductible.

However zero monthly premium plans may not be totally free Youll typically still have to pay some other costs like copays deductibles. Before June 1 2010 Medigap Plan J could also be sold with a high deductible.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

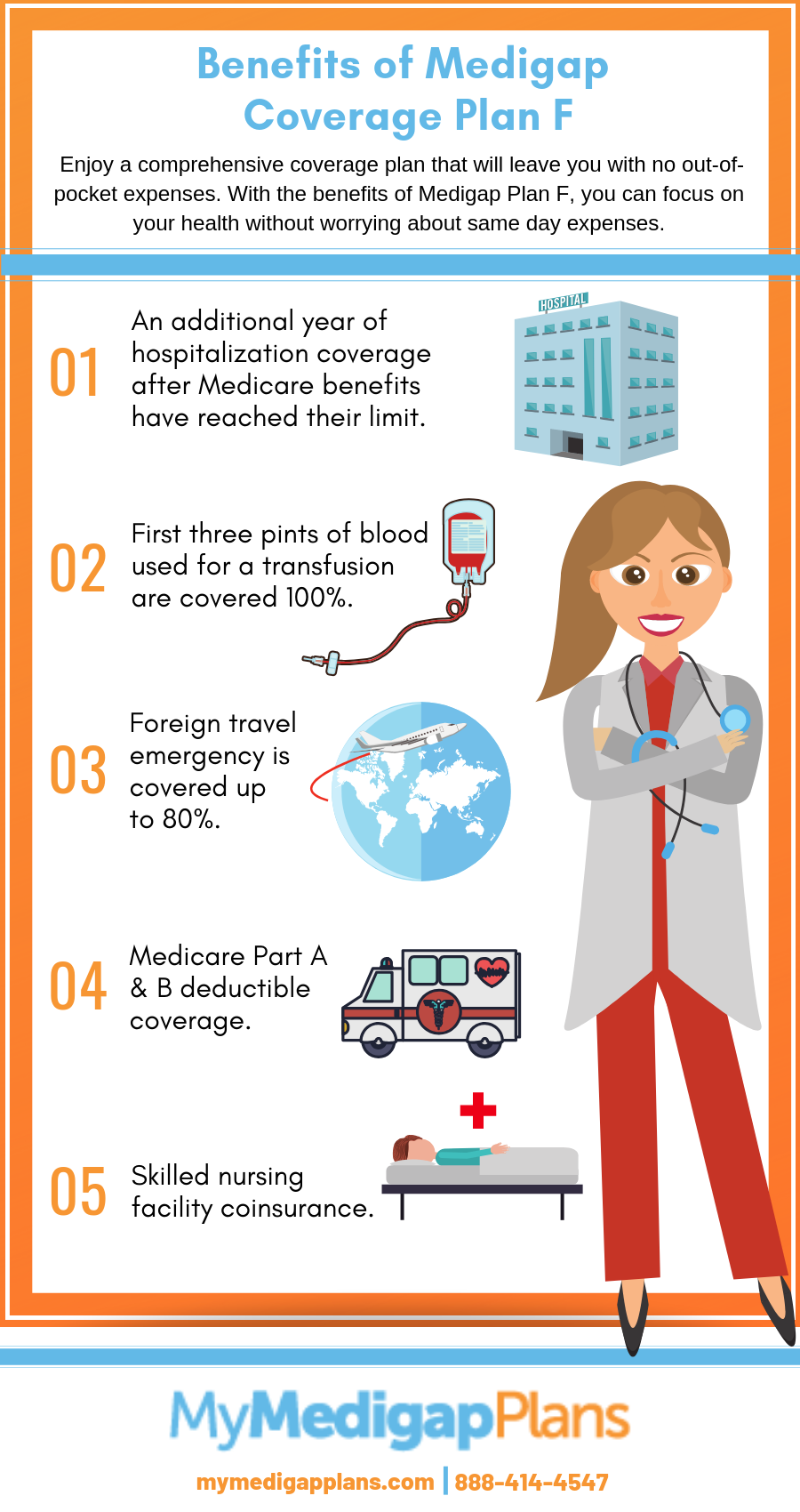

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

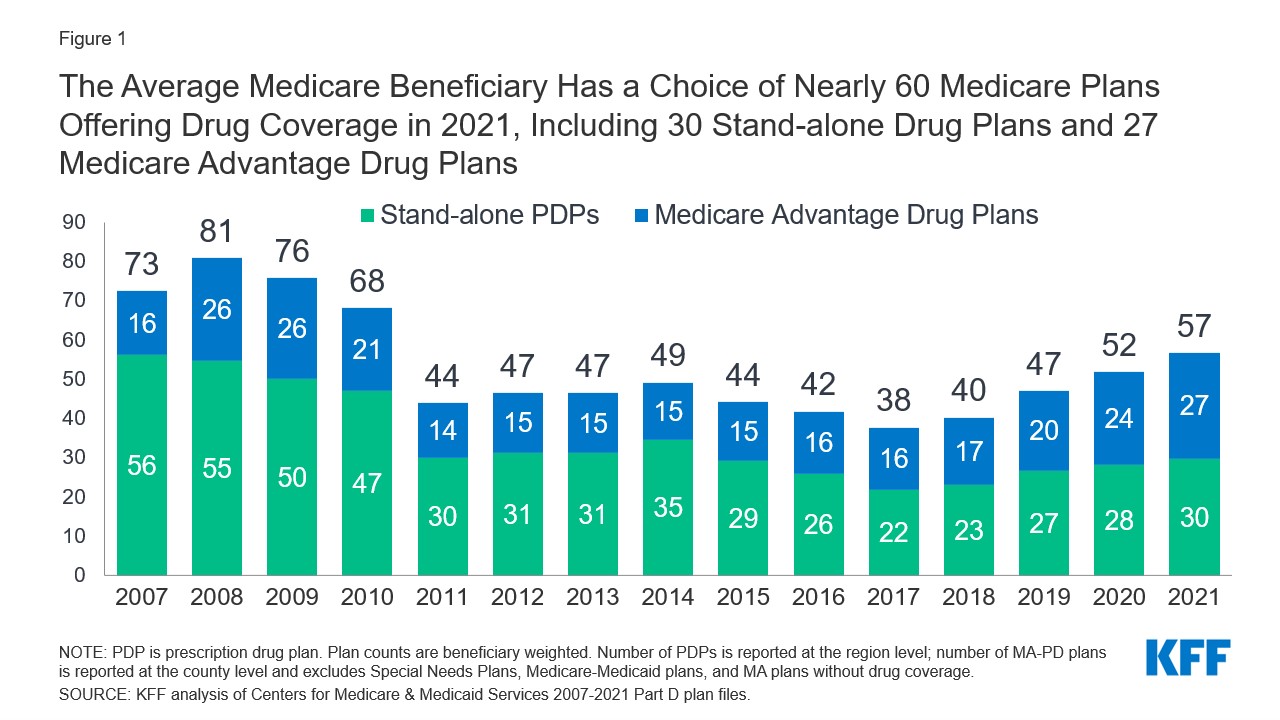

Medicare Part D A First Look At Medicare Prescription Drug Plans In 2021 Kff

Medicare Part D A First Look At Medicare Prescription Drug Plans In 2021 Kff

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Why We No Longer Recommend Plan F Integrity Senior Solutions Inc

Why We No Longer Recommend Plan F Integrity Senior Solutions Inc

Is There A Medicare Deductible Medicare Faqs

Is There A Medicare Deductible Medicare Faqs

Medicare Part D Prescription Drug Plans For Medigap

Medicare Part D Prescription Drug Plans For Medigap

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Medicare Prescription Drug Plan Deductible How Does It Work Dg Alcorn Associates 518 346 2115

Medicare Prescription Drug Plan Deductible How Does It Work Dg Alcorn Associates 518 346 2115

How Can Medicare Advantage Plans Have 0 Monthly Premiums

How Can Medicare Advantage Plans Have 0 Monthly Premiums

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.