Use our Penalty Estimator tool to estimate the penalty. You were not eligible for an exemption from coverage for any month of the year.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website.

Tax penalty for no health insurance 2020 california. Be the first to share what you. You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2020. Covered California said Tuesday that on average lower-income individuals received a subsidy of 608 per month when combining state subsidies and.

You may owe the fee for any month you your spouse or your tax dependents dont have qualifying health coverage sometimes called minimum essential coverage. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021.

An adult who is uninsured in 2020 face could be hit. Is this the penalty. You did not have health coverage.

You will have to pay a penalty the Individual Shared Responsibility Penalty when you file your state tax return if. My CA refund says I owed almost 400. Covered California estimates that Californians will save on average 167 per year in premiums during the 2020 coverage year.

If you live in a state that requires you to have health coverage and you dont have coverage or an exemption youll be charged a fee when you file your 2020 state taxes. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021. You pay the fee when you file your federal tax return for the year you dont have coverage.

If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021. California Health Insurance Penalty. 5 Vermont also enacted an individual mandate that takes effect in 2020 but the state has not yet created a penalty for non-compliance.

Log in or sign up to leave a comment Log In Sign Up. I have to pay the penalty for having no insurance for 9 months of the year. The penalty is applied when they prepare their annual state tax filings.

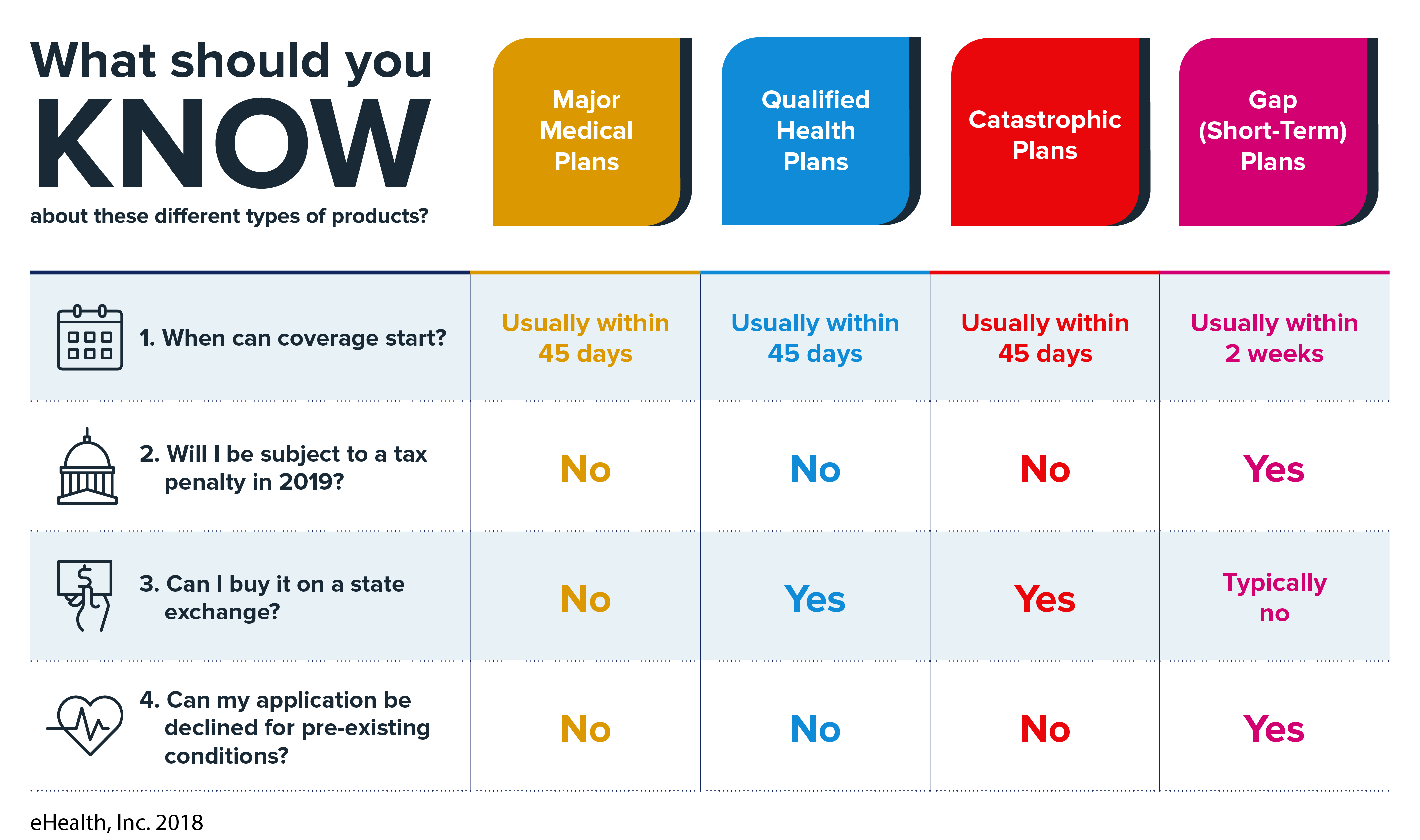

Get an exemption from the requirement to have coverage. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. California and Rhode Island California and Rhode Island both enacted legislation in 2019 to create state-based individual mandates effective in 2020 with tax penalties for non-compliance.

A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. See all insurance types that qualify. Your California state income.

The penalty for no coverage is based on. However Californians who can afford health insurance but choose not to purchase coverage may be subjected to a tax penalty. The penalty will amount to 695 for an adult and half that much for dependent children.

A new California law that went into effect on Wednesday resuscitates the requirement that people obtain health coverage or face tax penalties. Beginning January 1 2020 all California residents must either. The penalty will amount to 695 for an adult and half that much for dependent children or.

Subscribe to California Healthlines free Daily Edition. Or do I owe 400 and the additional penalty. Check with your state or tax preparer.

Starting in 2020 California residents must either. The number of people in your household. Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.