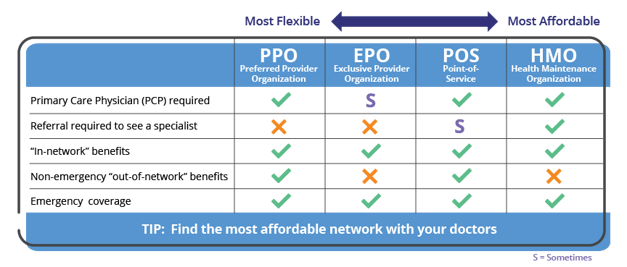

The less flexibility the less expensive. Another notable difference is that this plan offers cheaper premiums but lesser physician networks.

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

Cost of HMO PPO POS and EPO Insurance.

Hmo vs epo insurance. Lets take a look at some of the most common differences between these two types of health insurance plans. Was beinhaltet das HMO-Modell. The biggest draw to HMOs are the lower premiums and out-of-pocket expenses.

There are three common types of health insurance plans are HMO EPO and PPO plans. HMO insurance is often termed as an insured product meaning that the insurance company will pay the cost of the claim if it meets all coverage guidelines. HMOs have lower premiums and out-of-pocket expenses but less flexibility.

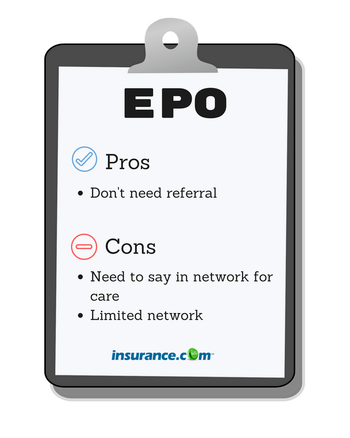

EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Like a PPO you do not need a referral to get care from a specialist. Finden Sie es direkt auf Comparis heraus.

Was beinhaltet das HMO-Modell. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Anzeige Basic insurance with your family doctor Calculate your premium now.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. But like an HMO you are responsible for paying out-of-pocket if you seek care from a. This is why PPOs tend to have higher premiums and deductibles when compared to HMOs and EPOs.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Finden Sie es direkt auf Comparis heraus. Finden Sie es heraus.

Meanwhile HMOs and EPOs do not cover out of network visits except in emergencies. But like HMO insurance youre not covered if you see out-of-network providers however as mentioned in the case of a medical emergency EPO insurance will cover some of the costs of out-of-network expenses. In comparison EPO insurance is often termed as a self-insured product in which the employer.

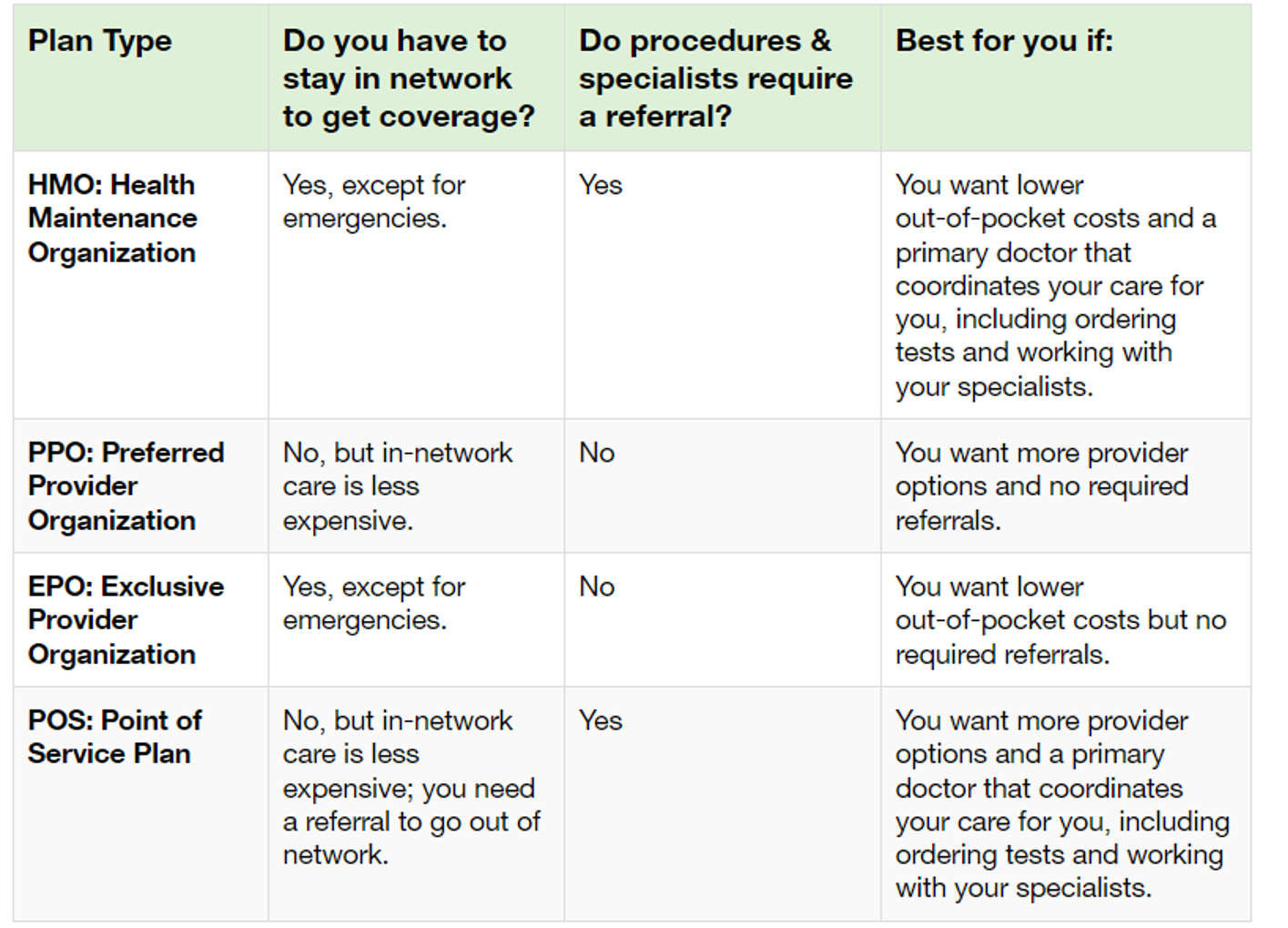

A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. While every plan differs in general the more flexibility a plan offers eg covering some percentage of out-of-network care or allowing patients to see a specialist without a referral the more it will cost in terms of premiums and cost-sharing eg deductibles. Each type of health insurance system will offer different options as you obtain services and the services are received through a network.

Your decision will be based on your income lifestyle and employment as well as your familys overall health finances and medical needs. Since the in-network providers all agree on the pricing level for their services this helps the HMOEPO to keep costs low. While EPO and HMO health insurance plans have some similarities they have even more differences.

Also unlike HMO EPO requires that your PCPs be paid for their services only when you are treated and not on a monthly basis. HMOs and EPOs tend to have lower monthly premiums. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common.

Finden Sie es heraus. Health maintenance organization HMO preferred provider organization PPO point of service POS and exclusive provider organization EPO plans are all types of managed healthcare. Cost is a major factor in choosing between plans.

When comparing the premiums the EPO has a lower premium than the HMO. This means you will have to pay for out-of-network service completely out-of-pocket. An HMO plan generally has a vast network of doctors whereas the EPO has only a limited network of doctors.

These plans also tend to have lower copays and coinsurance than other health insurance plans. Anzeige Basic insurance with your family doctor Calculate your premium now. The HMO is determined on a capitated basis whereas the EPO is based on the services provided.

Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician. Lets take a look at the features of each type of plan.

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Ppo Or Epo I Just Don T Know

Hmo Ppo Or Epo I Just Don T Know

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Individual And Family Health Plans Wilson Consulting Group

Individual And Family Health Plans Wilson Consulting Group

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.