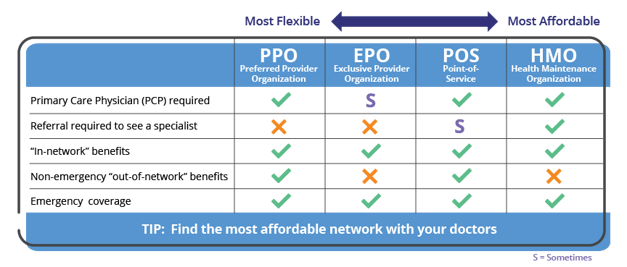

Your insurance will not cover any costs you get from going to someone outside of that network. PPOs cover care provided both inside and outside the plans provider network.

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Exclusive Provider Organization EPO health plans are similar to Health Maintenance Organizations HMOs as they do not cover care outside of the plans provider network.

Epo plan meaning. The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO. Comparing the EPO and PPO Plans. This means that you cannot go to out-of-network doctors and have it covered by your insurance except in an emergency but the premium and deductibles are usually the lowest of the three plan types.

They generally dont cover care outside the plans provider network. EPO stands for Exclusive provider organizations while PPOs are Preferred provider organizations. A type of managed care health insurance EPO stands for exclusive provider organization.

This reduces costs so your monthly payments will be lower. EPO Exclusive Provider Organization An EPO plan is less common than HMOs and PPOs but shares features of both. An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network.

The Exclusive Provider network or EPO is a managed care plan where services are covered only if you go to doctors specialists or hospitals in the plans network except in an emergency. Members however may not. An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribersBasically an EPO is a much smaller PPO.

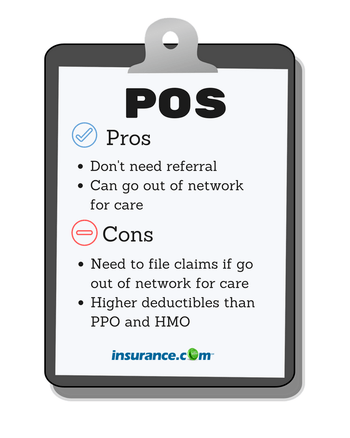

EPOs only cover care provided by the provider network. So for example if your plan has a 1000 deductible it might have a 2000 deductible for out-of-network care. Unlike HMOs EPOs usually do not require patients to select a primary care physician and do not require referrals to see specialists.

What Is an EPO Exclusive Provider Organization. This gives you the option of trying local food and save some money as well. EPO stands for exclusive provider organization and doesnt cover any out-of-network care.

However kidney therapeutic segment would emerge as the largest market segment by 2020 Erythropoietin Drugs Market is Expected to Reach 119 Billion Globally by 2020. An EPO is a hybrid between an HMO and PPO plan. This means that in an HMO planyou do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network.

Many people have an understanding of what a PPO is but much fewer could answer what is an EPO plan. EPO insurance plans offer a very limited number of providers who offer large discounts on their rates. Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician.

Under an EPO plan you can go to a doctor andor hospital that is in-network. As you quote the new Exchange and non-Exchange plans youll see some new terms that might be new to you especially on the network side. The plan offers a local network of doctors and specialists in your area in which you can choose from.

Like HMOs these plans do not pay for out-of-network care except in some emergency circumstances. Exclusive Provider Organizations EPO also provides access to a network of providers. EPO health insurance stands for Exclusive Provider Organization.

EPO may improve cognitive impairment in depression - Currently Anemia therapeutics Cancer and HIV treatment market leads the overall EPO drugs market. However there are no out-of-network benefits - meaning you are responsible for 100 of expenses for any visits to an out-of-network doctor or hospital. Exclusive provider organizations EPOs are a lot like HMOs.

EPO and PPO are essentially two different types of healthcare insurances. The more a plan pays for out-of-network. In plans that pay a portion of your costs when you see out-of-network providers your out-of-pocket charges will generally be quite a bit higher usually double than they would be if you saw in-network doctors.

A Blue Dental EPO plan only covers services from in-network PPO dentists. EP or European Plan European Plan or EP will mostly have the lowest tariff in a rate card simply because it includes only room rent and no meals.

Epo Health Plans Independence Blue Cross Ibx

What Does Epo Mean In Health Insurance Business Benefits Group

What Does Epo Mean In Health Insurance Business Benefits Group

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

What Is An Epo Health Insurance Plan

What Is An Epo Health Insurance Plan

Epo Insurance Guide Affordable Insurance Healthcare

Epo Insurance Guide Affordable Insurance Healthcare

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

Comparing Health Plan Types Kaiser Permanente

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

The Insurance Basics Cf Foundation

The Insurance Basics Cf Foundation

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.