Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut. Small Employer 2 to 19 employees.

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Much like federal COBRA Cal-COBRA is a California law that lets you keep your group health plan when your job ends or your hours are cut.

Cal cobra vs cobra. It is also worth noting that group health benefits through an employer including COBRA coverage are usually more expensive than individual health plans purchased on the individual Covered California. Read more about Cal-COBRA. Cal-COBRA is a California law that is like Federal COBRA Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees.

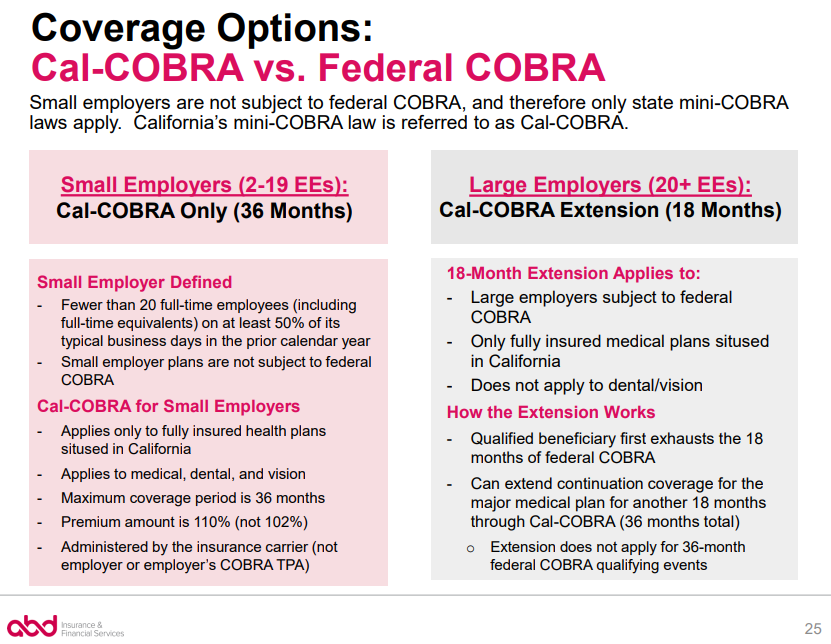

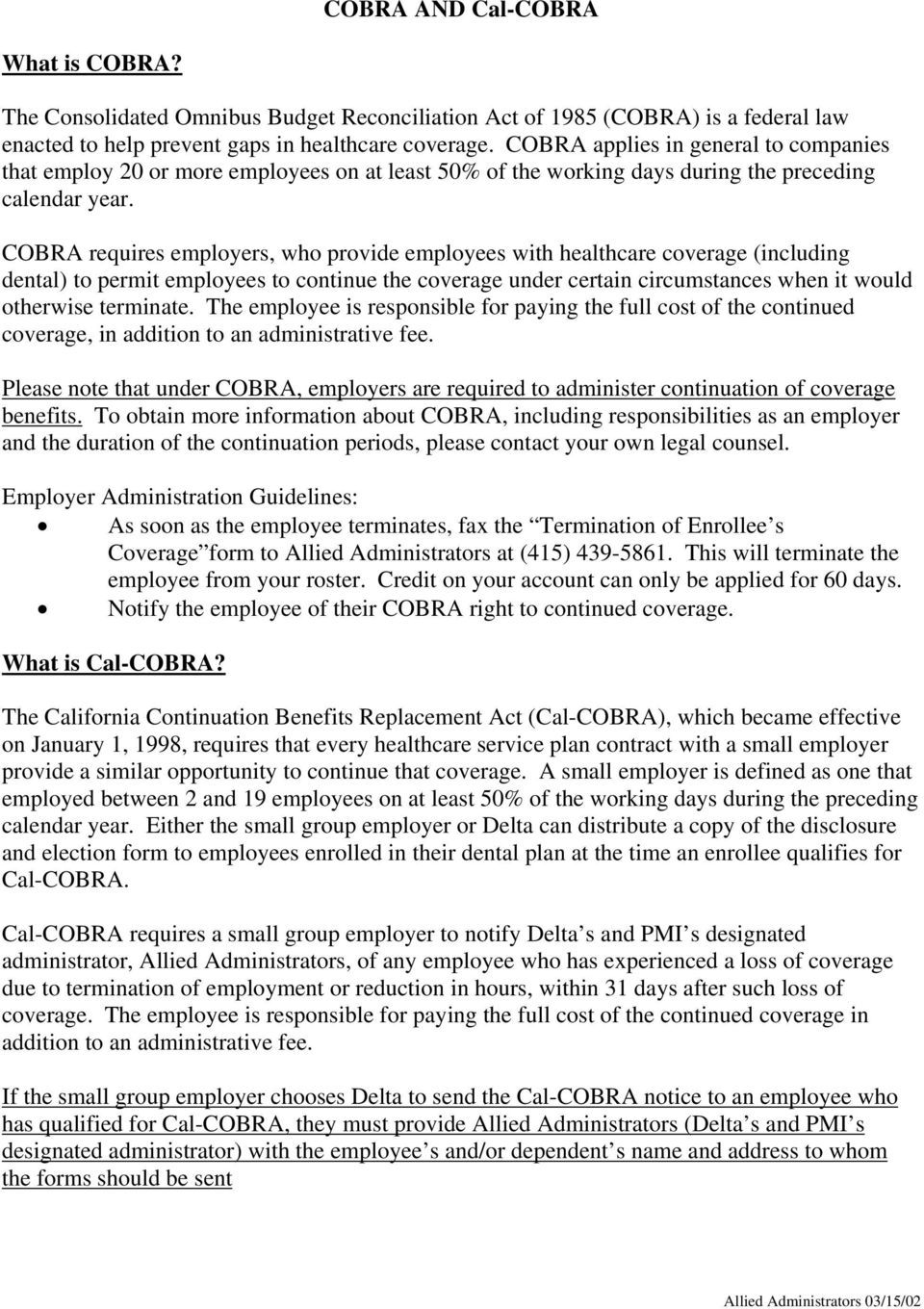

The California Continuation Benefits Replacement Act of 1997 Cal-COBRA requires insurance carriers and HMOs to provide COBRA-like coverage for employees of smaller employers two to. We typically recommend that employers with 20 or more employees outsource the COBRA administration to one of our preferred third-party administrators TPA as COBRA requires a number of plan notifications to take place at different stages in the COBRA process. COBRA an acronym for the federal Comprehensive Omnibus Budget Reconciliation Act has become shorthand of sorts for an employees right to continue her employer-provided group health insurance coverage when she leaves her job.

2 It lets you keep your health coverage for a total of up to 36 months. Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees. In addition to this full premium federal COBRA usually contains an additional 2 administrative fee and Cal-COBRA contains an additional 10 administrative fee.

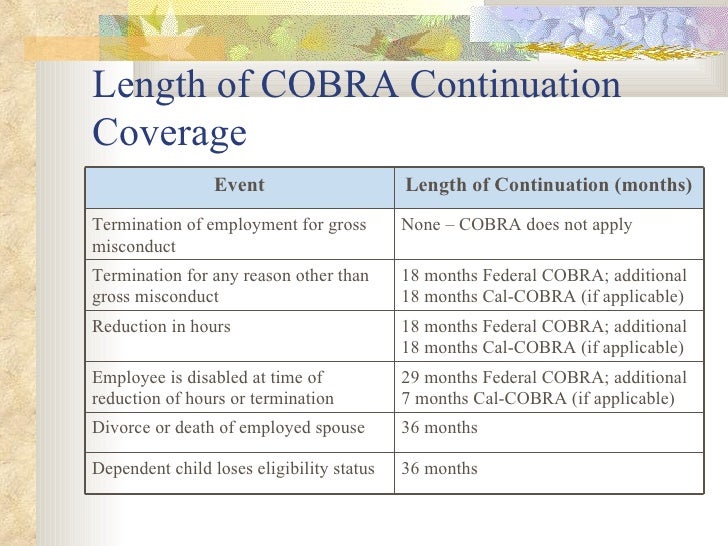

For COBRA employees are responsible for the entire cost up to 102 percent of the group rate. COBRA is not an insurance company. The California Continuation Benefits Replacement Act of 1997 Cal-COBRA requires insurance carriers and HMOs to provide COBRA-like coverage for employees of smaller employers two to 19 employees not covered by COBRA.

Cal-COBRA applies to employers and group health plans that cover from two to 19 employees. Would they be COBRA or Cal COBRA. If you qualify for a Covered Ca tax credit its hard to justify paying full premium for Cobra.

Listed below are some highlights of Federal COBRA vs. Covered California can be priced much lower and you can change plans. It lets you keep your plan for up to 36 months.

Cal-COBRA is different from the federal program in two ways. At least 110 of the premium the employer pays if it is based on the age of covered employees. Since you mention Cal-COBRA it sounds like you are in California.

COBRA is a federal law that gives employees and their families who lose health benefits the ability to choose to continue group health benefits. In the decades since federal COBRA. 1 Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2021 Google LLC. COBRA is a federal law that requires employers with 20 or more employees to offer the continuation of the same group health care coverage after youve voluntarily or involuntarily left your job or have had your work hours reduced. Cal-COBRA is also for people who use up their Federal COBRA.

It may also be available to people who have exhausted their federal COBRA. The Consolidated Omnibus Budget Reconciliation Act COBRA is a federal law. For more information on Federal COBRA and Cal-COBRA please visit the California Department of Managed Healthcare website.

For Cal-COBRA the cost may range from 110 to 150 of the group rate. Cobra 6 vs a volkswagen. For COBRA you will pay 102 of the premium the employer pays.

For CalCOBRA you will pay. Also once federal COBRA is exhausted Cal-COBRA may extend continuation coverage up to a combined total of 36 months of. Any premium for COBRA is in addition to any premiums you pay for Medicare and is not reduced when COBRA is secondary coverage to Medicare.

Federal State Mini-COBRA Chart The federal Consolidated Omnibus Budget Reconciliation Act COBRA generally requires employers with 20 or more employees with group health plans to offer employees their spouses and their dependents a temporary periodqualifiedof continued health care coverage if they lose coverage through the employers plan. Cobra is really expensive and you might not be able to change plans. The COBRA statute requires employers to offer continuation of group coverage eg medical dental and vision to covered employees spouses domestic partners and eligible dependent children who lose group coverage due to a qualifying event.

It may also be available to people who have exhausted their Federal COBRA. Again our services as Certified Covered California agents is free to you. These individuals are known as qualified.

Deciding Between Cobra Insurance Or California Health Insurance

Deciding Between Cobra Insurance Or California Health Insurance

Cobra Vs Cal Cobra What S The Relationship And What S The Difference Susan Polk Insurance Agency Inc San Luis Obispo California

Cobra Vs Cal Cobra What S The Relationship And What S The Difference Susan Polk Insurance Agency Inc San Luis Obispo California

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Small Employer Exception Abd Insurance Financial Services

King Cobra Vs King Cobra Real Fight To Death Snake Attack Snake Most Amazing Attack Of Animals Youtube

King Cobra Vs King Cobra Real Fight To Death Snake Attack Snake Most Amazing Attack Of Animals Youtube

.png) How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

California Choice Small Business Health Insurance

Blue Shield California Cal Cobra Fill Online Printable Fillable Blank Pdffiller

Blue Shield California Cal Cobra Fill Online Printable Fillable Blank Pdffiller

Firecracker Powertest Cobra 1 Cobra 3 Cobra 5 Cobra 6 Cobra 7 Cobra 8 Big Boy Youtube

Firecracker Powertest Cobra 1 Cobra 3 Cobra 5 Cobra 6 Cobra 7 Cobra 8 Big Boy Youtube

Short Term Health Insurance Plans Vs Cobra

Short Term Health Insurance Plans Vs Cobra

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cobra And Cal Cobra What Is Cobra Pdf Free Download

Cobra And Cal Cobra What Is Cobra Pdf Free Download

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.