Check out our affordable health plans and calculate your premium. Check out our affordable health plans and calculate your premium.

Once you meet your deductible your HDHP starts to cover your medical expenses as outlined in your plan.

Hsa qualified health insurance plans. For a health plan to be HSA-qualified it must meet the following criteria for 2018. Tap into millions of market reports with one search. Whether or not you can continue to make contributions depends on your new insurance plan.

You can also filter to see only HSA-eligible plans by using the Filter. - Free Quote - Fast Secure - 5 Star Service - Top Providers. An HSA doesnt have copays on doctors visits or prescription drugs before the deductible.

You have no other health coverage except what is permitted under Other health coverage later. The term HSA-qualified insurance refers to health insurance policies that meet certain requirements relating to deductibles out-of-pocket expenses covered benefits and preventive care. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

What is HSA-qualified health insurance. Providence Choice Network and Providence Signature Network. You can contribute to your HSA so long as youre enrolled in a qualified HDHP.

Two networks depending in the county where you live. The HDHP enrollment rule also applies to outside contributions those from an employer or other person. If you later re-enroll in a qualified HDHP.

Qualifying for an HSA. Get the Best Quote and Save 30 Today. If you change to a non-HDHP plan you can no longer make contributions.

When you view plans in the Marketplace you can see if theyre HSA-eligible. With an HSA Qualified plan paired with a tax-exempt health savings account you save pre-tax dollars to pay for future health care expenses. Advertentie Get more out of your healthcare insurance.

A QHDHP can have no first dollar benefits. For plan year 2019 the minimum deductible is 1350 for an individual and 2700 for a family. Advertentie Get more out of your healthcare insurance.

An HSA can help pay for qualified medical expenses such as copays deductibles coinsurance and dental and vision costs. Advertentie Unlimited access to Health Insurance market reports on 180 countries. What you need to know about the HSA-Qualified Health Plan that is required to begin making deposits to a Health Savings Account.

Preventive services are paid 100 with no cost sharing. Get the Best Quote and Save 30 Today. Advertentie Compare Top Expat Health Insurance In Netherlands.

Tap into millions of market reports with one search. Covered charges are paid after the deductible is met. Make sure the health plan is HSA-qualified.

Access to specialists via referral from the medical home for HSA. If not here are three things to tell employer clients about how they can nudge employees onto HSA-qualified health plans. Advertentie Compare Top Expat Health Insurance In Netherlands.

These plans have specific limitations that Congress intended as a complement to the HSA. To be an eligible individual and qualify for an HSA you must meet the following requirements. Advertentie Unlimited access to Health Insurance market reports on 180 countries.

An HSA qualified plan is an inexpensive high deductible health insurance plan. The minimum deductible must be no less than 1350 for individual plans. Plans that meet these requirements are also called high deductible health plans or HDHPs.

You are covered under a high deductible health plan HDHP described later on the first day of the month. For more in-depth content become a member buy the HSA Owners Manual by Todd Berkley or ask a question specific to your situation with Ask Mr HSA custom answer service. HSA Qualified plans offer.

This might seem like a no. How to find an HSA-eligible HDHP When you compare plans on HealthCaregov HSA-eligible HDHPs are identified on plan cards by an HSA-eligible flag in. For plan year 2020 the minimum deductible for an HDHP is 1400 for an individual and 2800 for a family.

Anyone is eligible to establish an HSA but in order to actually put money into the account you have to be insured by a Qualified High Deductible Health Plan QHDHP. Rules for HSA-Qualified Plans. You can continue to use your HSA funds to cover copays and coinsurance.

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

5 Things To Know About Health Savings Accounts Thinkhealth

Deadline For An Hsa Qualified Health Insurance Plan Hsa For America

Deadline For An Hsa Qualified Health Insurance Plan Hsa For America

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

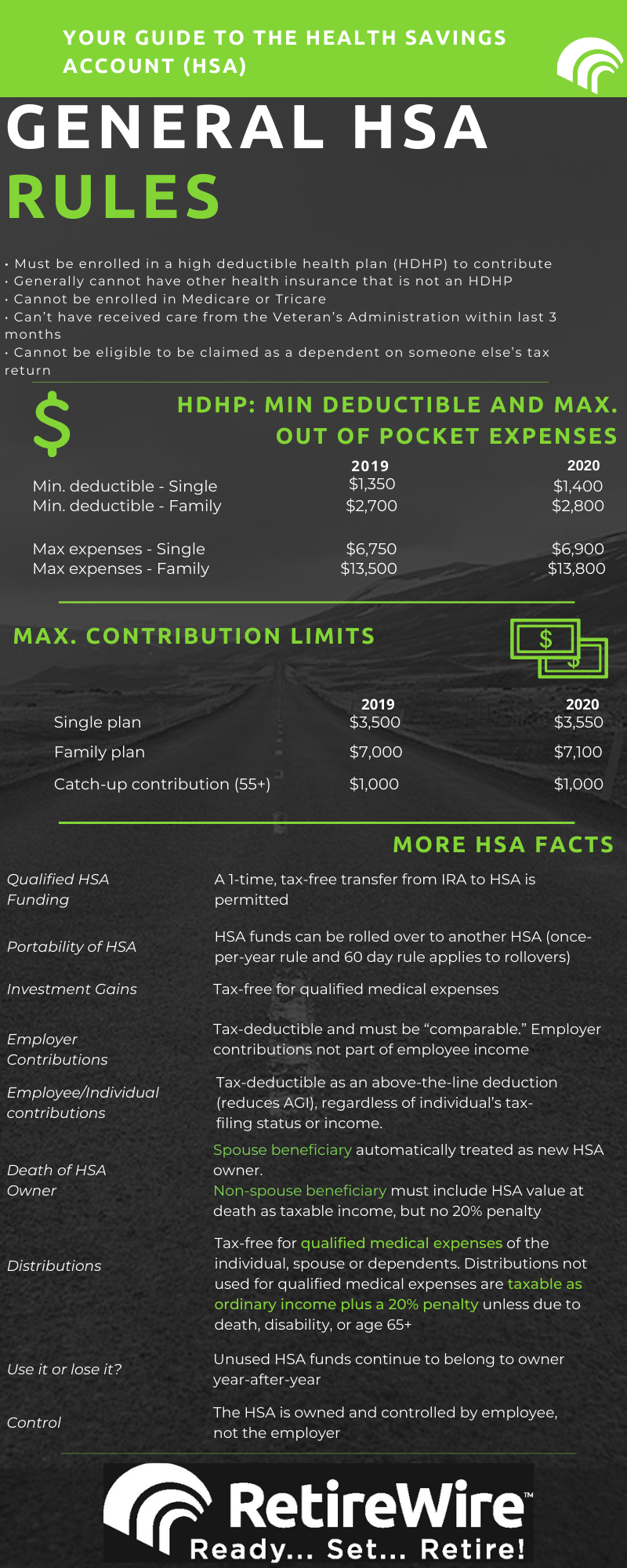

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

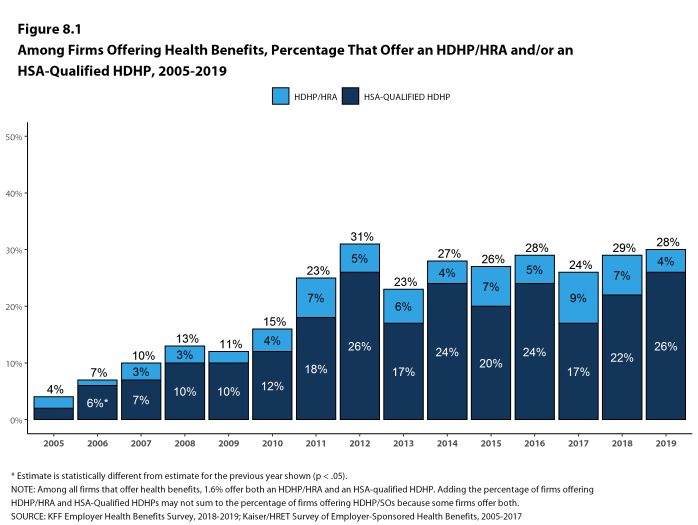

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.