Another major difference between the two relates to flexibility. A preauthorization or prior authorization requirement means the health insurance company requires you to get permission from them for certain types of healthcare services before youre allowed to get that care.

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

However there are no out-of-network benefits - meaning you are responsible for 100 of expenses for any visits to an out-of-network doctor or hospital.

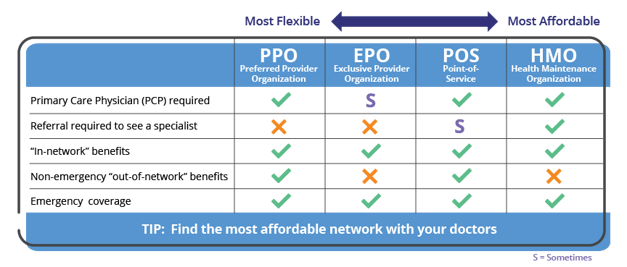

Epo meaning insurance. HMOs PPOs EPOs and POS plans are all different types of managed care plans that simply means the insurance company tries to balance the cost and quality of care for its customers by contracting physicians to its network. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

For that reason an EPO health insurance plan may be well-suited for those whose doctor is either part of their. Having an Exclusive Provider Organization EPO means that the medical service providers you will receive care from should have signed up an agreement with the insurance company to allow offering you these services. The plan offers a local network of doctors and specialists in your area in.

What does EPO stand for in Insurance. There are no out-of-network benefits. Its important to note that those with an EPO plan have health insurance coverage only for in-network doctors and hospitals and there are no out-of-network benefits except for emergencies.

Under an EPO plan you can go to a doctor andor hospital that is in-network. You must stay within the EPO network in order to get help from the carrier. EPO health insurance stands for Exclusive Provider Organization.

EPO Exclusive Provider Organization health insurance in-depth overview. EPO Health Insurance Plans. When considering their difference the HMO can be termed as an insured product which means that the insurance.

EPO stands for Exclusive Provider Organization plan. What is an EPO plan. Preferred provider organizations PPOs cover care provided both inside and outside the plans provider network.

Insurance EPO abbreviation meaning defined here. This way EPO plans are somewhat similar to PPO Preferred. Exclusive Provider Organization EPO health plans are similar to Health Maintenance Organizations HMOs as they do not cover care outside of the plans provider network.

Get the top EPO abbreviation related to Insurance. HMO stands for Health Maintenance Organization and EPO stands for Exclusive Provider Organization. HMO insurance is often termed as an insured product meaning that the insurance company will pay the cost of the claim if it meets all coverage guidelines.

Usually the EPO network is the same as the PPO in terms of doctors and hospitals but you should still double-check your doctorshospitals with the new Covered California plans since all bets are off when it comes to networks in the new world of health insurance. Your insurance will not cover any costs you get from going to someone outside of that network. In comparison EPO insurance is often termed as a self-insured product in which the employer pays the costs.

An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribers. Like a PPO you do not need a referral to get care from a specialist. Well there are several technical differences between HMO and EPO.

A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. Basically an EPO is a much smaller PPO. An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network.

EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Difference Between HMO and EPO HMO vs EPO HMO and EPO are both health insurance schemes. As a member of an EPO you can use the doctors and hospitals within the EPO network but cannot go outside the network for care.

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What Is An Epo Health Insurance Plan

What Is An Epo Health Insurance Plan

Epo Insurance Guide Affordable Insurance Healthcare

Epo Insurance Guide Affordable Insurance Healthcare

The Insurance Basics Cf Foundation

The Insurance Basics Cf Foundation

Epo Health Plans Independence Blue Cross Ibx

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Understanding The Difference Between In Network And Out Of Network Provider Coverage

Understanding The Difference Between In Network And Out Of Network Provider Coverage

What Does Epo Mean In Health Insurance Business Benefits Group

What Does Epo Mean In Health Insurance Business Benefits Group

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.