This will allow you to make a change to the health plan for the household. This will trigger the Change Plan link to become active.

Covered California Makes It Easier To Pay And Cancel Coverage

Covered California Makes It Easier To Pay And Cancel Coverage

Will I be able to use my new Covered California health insurance plan right away.

When can i change my covered california plan. When someone enrolls in a health insurance plan during open enrollment but after Jan. You can switch to Kaiser then and the new coverage will be effective on January 1 2019. I suggest you delegate a Certified Insurance Agent to help you with it.

So if you call on June 1 and request to cancel your plan on June 15 your. Call 888 413-3164 or Shop Online Now. Now you should be able to select another plan effective February 1st.

This is a quirky process in the Covered California online application system. You can change your Marketplace health coverage through August 15 due to the coronavirus disease 2019 COVID-19 emergency. You can terminate your Anthem Plan effective April 30th and choose the Blue Shield plan you want effective May 1st.

Learn more about new lower costs. I tried to call but I waited on hold for more than an hour and when I was finally able to speak with a representative she hung up on me. Sometimes these changes make you eligible for special enrollment at which point you can change your plan.

What if I want to change something about my health coverage or renew my plan through Covered California. How can I upgrade it. I just realized that I am not happy with my Kaiser plan.

Renewal usually starts in the fall right before the open-enrollment period. The Golden State is getting a pleasant surprise in 2021. Officials say the money saved by Californians will strengthen the states economy as residents take advantage of the benefits reducing their.

Have a change in income. It is not recommended to request a mid-month termination. Clicking on that link will allow you to make a change to your health plan enrollment for 2016.

Compare different plans to get the best coverage for your needs and budget. Have a child adopt a child or place a child for adoption. Pay your insurance carrier to activate your new plan and get confirmation from them that you are enrolled on your new plan before cancelling your old one.

Get health coverage through a job or a program like Medicare or Medi-Cal. I enrolled in Covered California last December. If you need to change the health plan that Covered California has summarily renewed you into and you dont want dental insurance you need to decline the dental coverage.

The renewal period for Covered California has ended. During the renewal period for your health insurance plan you will be able to. 1 2014 will the effective date be Jan.

You cant change your health insurance plan until the next open enrollment period which is November-December 2018. You will directed to select a termination date that is a least 2 weeks from today. Covered CA Plan Benefit Changes for 2021.

Get married or divorced. If you have health insurance through Covered California you must report changes within 30 days. I plan to stay with Covered California but I want to changeupgrade my plan without being kicked out of.

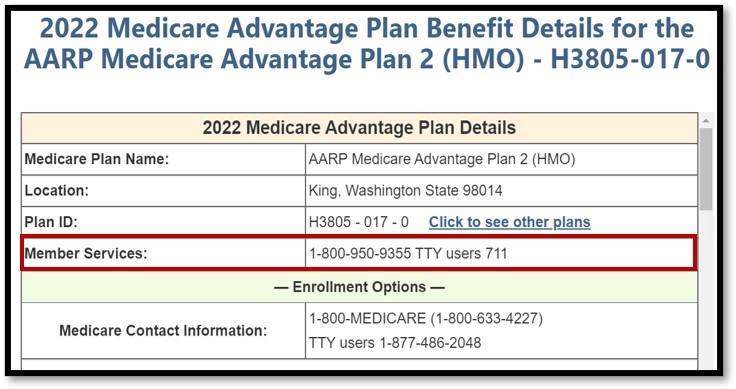

Call Covered CA at 1-800-300-1506 to see if they show you enrolled on more than one plan. You usually have 60 days from the life event to enroll in a new plan but you should report your change as soon as possible. Many Covered California families are reporting that the primary applicant for their 2020 health plans have been changed.

Speak with a Covered California certified agent. This is because your health or dental insurance company is not obligated to refund prorated premiums. Once you have either declined the dental or selected a dental plan the Change Plan link under the action box will become active.

Renewal will begin again in the fall of 2021. You can also still change 2021 health plans any time if you qualify for a Special Enrollment Period due to a life event like losing other coverage getting married moving or having a baby. Allow 2-5 business days for Covered CA to process your newly submitted application.

You can change your plan selection any time before the current open enrollment period ends on Jan 30 2016. 1 or is it subject to the actual enrollment date. Covered California rates are going up 06 on average and the plan benefits are not changing very much.

You can always report changes when things like your household size and income have changed. If you want the new coverage on February 1st select a termination date of January 31st. Renewal usually starts in the fall right before the open-enrollment period.

At that point youll be able to switch your plan and make any changes. Also with a Special Enrollment Period. For example to end coverage on June 30 you would need to call Covered California by June 16 to request the cancellation of your plan.

Minor Benefit Changes on Bronze Silver Gold and Silver 87. Instead of the Covered California primary applicant also being the primary applicant on the health plan it has been changed to their spouse. You must report a change if you.

At that point youll be able to switch your plan and make any changes. If youre currently enrolled in Marketplace coverage you may qualify for more tax credits. You cant change the plan that Covered California has automatically renewed you into until you make a decision on the family dental plan option.

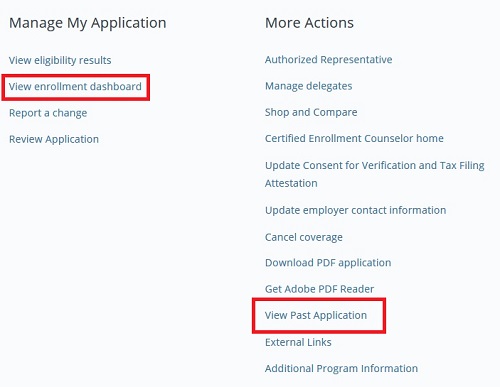

Login in to your Covered California account and select Terminate Participation Click on image to enlarge. Bronze Silver and Gold. Can I change still my plan to something else.

Review and update your contact information and application.