Figuring out how to stack these benefits and get the most out of them requires a little context and a lot of explanation. HSA is health savings account.

Fsa Vs Hra Vs Hsa What Are The Similarities And Differences

Fsa Vs Hra Vs Hsa What Are The Similarities And Differences

Key differences between an HSA and an HRA.

Hra and hsa. 100 tax-free contributions reimbursements. Can an employee have an HRA and an HSA at the same time. HSAs and HRAs.

Absolutely yes However employers need to understand how the two benefits interact to determine if it will accomplish their goals. A post-deductible HRA is essentially an HRA that has its own deductible. The comparison chart below illustrates the most notable similarities and differences between the two benefits.

HSAs and HRAs have a lot in common but also have key differences that should be highlighted. And unlike an HSA your employer controls the HRA and only they can contribute money into it. HSAs HRAs and FSAs are types of accounts you can use to pay for certain health care expenses for you and your covered dependents.

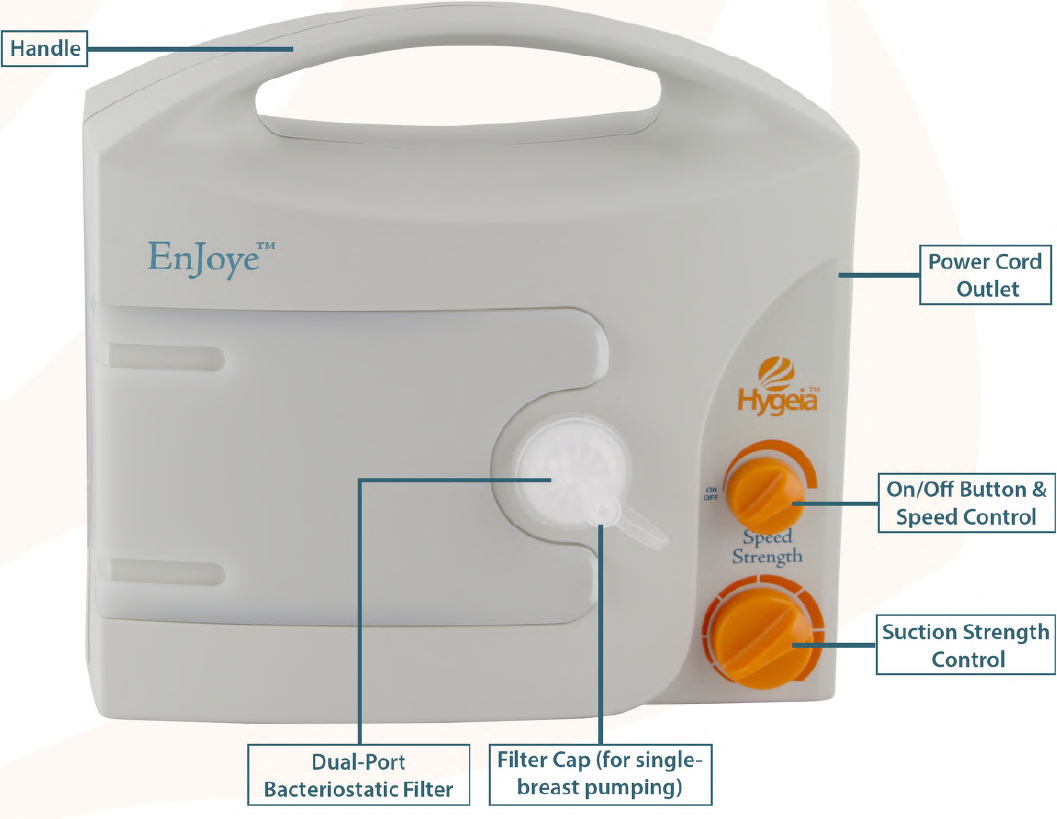

But employers can offer any of these accounts and sometimes more. A Health Reimbursement Account or HRA and a Health Savings Account or HSA differ in terms of eligibility requirements who contributes into them how the contributions work who has ownership of the account how portable funds are and how the funds can be used. These cover qualified medical expenses after retirement.

HRA is health reimbursement account or arrangement. With HSAs you avoid the use it or lose it stipulation. They also provide more control over how and where to pay for those expenses.

Can my employer design an HRA program that helps me offset my deductible expenses and allows me to become or remain HSA-eligible. Healthcare spending accounts such as Health Reimbursement Arrangements HRAs and Health Savings Accounts HSAs help individuals and families pay for medical expenses. An account set up and funded by your employer to help pay for.

A health savings account HSA is a bank account you own to pay for eligible health care expenses or you can use it to save toward retirement. Thats because youre only eligible for an HSA. If you buy your own insurance you dont need to worry about comparing all these accounts.

What are HSAs HRAs and FSAs. Lets a look a bit more closely at what these tax-advantaged options actually are. A common question we receive is Can an employee have an HRA and HSA at the same time The answer is.

At this point you can use your HRA. HSAs HRAs and FSAs are accounts used to pay for qualified medical expenses prescription drugs dental and vision expenses. It can be used to reimburse employees for regular medical expenseseven before theyve met their full HDHP deductiblebut only after theyve paid at least the minimum allowable HDHP deductible amount.

While HSAs have to be paired with a high-deductible insurance plan HRAs do not have that restriction. Health Savings Account HSA is a savings account to which you and your employer if they choose can contribute pre-tax dollars if you are enrolled in an eligible High Deductible Health Plan. If the HRA meets the requirements for an HSA-qualified medical plan and you satisfy all other eligibility.

100 tax-free contributions reimbursements and interest accrual. However you can use your HSA up until that point in time before you lose eligibility for an HSA. HRAs boast no payroll tax for employers and no income tax for employees.

HRA you cant open or contribute to an HSA even if your primary medical coverage is HSA-qualified. An HRA allows an employer to retain unused benefit funds while an HSA is a portable account that the employee owns. FSA is flexible spending account or arrangement.

Both Health Reimbursement Arrangements HRAs and Health Savings Accounts HSAs are designed to help people pay for out-of-pocket medical expenses for themselves and their families through set-aside funds. The two can be used together in a combined benefit that some employees may prefer. They also provide participants also known as healthcare consumers more control over their personal healthcare.

Post-deductible HRAs are also compatible with HSAs. HRAs are a great standalone benefit while an HSA is a great companion benefit. Both Health Reimbursement Arrangements HRAs and Health Savings Accounts HSAs are tax-advantaged tools that help individuals pay for out-of-pocket medical expenses for themselves and their families through set-aside funds.

Covers qualified medical expenses after you pay off your deductible.